REMZİ AKÇİN

UGM Chairman of the Board of Directors

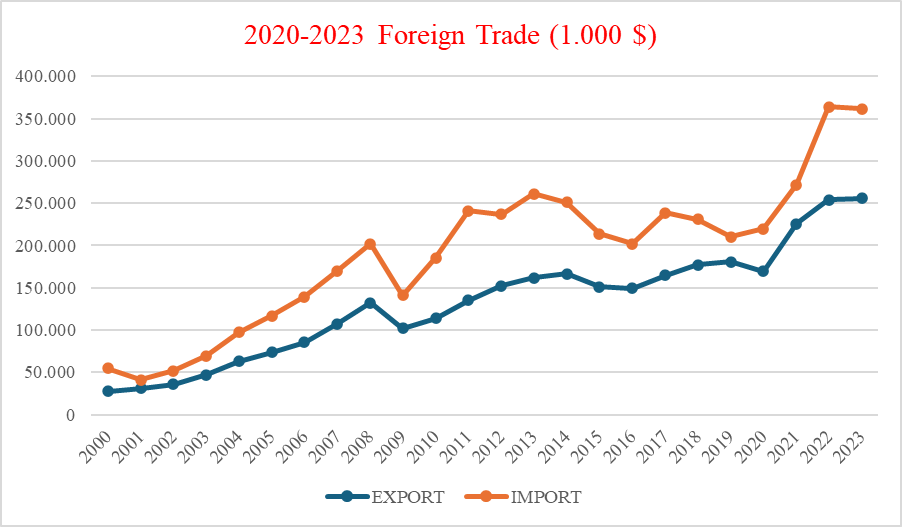

The foreign trade deficit is one of the most fundamental problems of our country. When we analyze the 23 years since 2000, we see that the general outlook is that the ratio of exports to imports is between 51% and 83%, but on average 70% of our imports are financed from export revenues. Therefore, we face the problem of financing 30% of our imports each year through non-export means.

The largest share of imports is undoubtedly energy imports. In 2023, Turkey's energy imports amounted to $69.1 billion, down 28% compared to 2022. This cost increases or decreases occasionally due to international turmoil, but these fluctuations are mostly due to factors beyond our country's control.

| YEAR | EXPORT | IMPORT | EX/IM | YEAR | EXPORT | IMPORT | EX/IM |

| 2000 | 27.775 | 54.503 | 51 | 2012 | 152.462 | 236.545 | 64,5 |

| 2001 | 31.334 | 41.399 | 75,7 | 2013 | 161.481 | 260.823 | 61,9 |

| 2002 | 36.059 | 51.554 | 69,9 | 2014 | 166.505 | 251.142 | 66,3 |

| 2003 | 47.253 | 69.340 | 68,1 | 2015 | 150.982 | 213.619 | 70,7 |

| 2004 | 63.167 | 97.540 | 64,8 | 2016 | 149.247 | 202.189 | 73,8 |

| 2005 | 73.476 | 116.774 | 62,9 | 2017 | 164.495 | 238.715 | 68,9 |

| 2006 | 85.535 | 139.576 | 61,3 | 2018 | 177.169 | 231.152 | 76,6 |

| 2007 | 107.272 | 170.063 | 63,1 | 2019 | 180.833 | 210.345 | 86 |

| 2008 | 132.027 | 201.964 | 65,4 | 2020 | 169.638 | 219.517 | 77,3 |

| 2009 | 102.143 | 140.928 | 72,5 | 2021 | 225.291 | 271.424 | 83 |

| 2010 | 113.883 | 185.544 | 61,4 | 2022 | 254.170 | 363.711 | 69,9 |

| 2011 | 134.907 | 240.842 | 56 | 2023 | 255.441 | 361.765 | 70,6 |

Almost everyone agrees that the healthiest and most sustainable way to eliminate the foreign trade deficit is to increase export revenues. The following example is a clear example of how the will of the legislator to increase exports evaporates in the corridors of legislation and how the ear has to be pointed backward to overcome the legislative obstacle.

SUPPORT FOR EXPORT-ORIENTED PRODUCTION IN FREE ZONES

Provisional Article 3 of the Free Zones Law No. 3218 provides “...exemption from income tax calculated on the wages paid to the personnel employed due to the export of at least 85% of the FOB value of the products produced abroad...”. In other words, the legislator has provided income tax exemption to encourage the export of 85% or more of the products produced in free zones.

In particular, due to the employment of qualified personnel, the income tax cancellation application on wages, which is utilized within the scope of the 85% export requirement, provides significant advantages to companies and has an employment boosting effect. For this reason, production under the 85% export requirement is important both for the companies producing in the free zone and for our country due to its effect on reducing the foreign trade deficit.

According to the Temporary Article 3 of the Free Zones Law, the procedures and principles for benefiting from this support are determined by the Ministry of Treasury and Finance. To fill this gap, the Ministry of Treasury and Finance prepared the General Communiqué on the Free Zones Law No. 3218 (Serial No: 1), and the Communiqué was published in the Official Gazette dated 12.03.2009 and numbered 27167.

To benefit from the subsidy; in addition to the export of the goods, under Article 3.5 of the Communiqué titled “Delivery of Goods on the Condition of Export”; “The delivery of the products of the producer companies engaged in production activities in the free zone to the exporters operating in the same or another free zone, provided that they are sold abroad, is also considered as sales abroad”. In other words, for the product produced in the free zone to benefit from export support, either the producer must export this product directly or deliver it to exporters operating in the free zone on the condition of export. Any other alternative is not considered an export.

INWARD PROCESSING REGIME

In the inward processing regime, the import of the inputs used in the production of the products to be exported is allowed by pledging the customs duties as collateral, and the collateral received is returned upon proof that the product produced is exported. Nearly half of our country's exports are exports made under the inward processing regime. This rate alone shows how valuable this regime is for our exports.

The product produced in free zones is sometimes used within the product produced within the scope of the inward processing regime. In this case, the product produced both in the free zone and in the inward processing regime is ultimately exported, but it is not considered an export by the legislation mentioned above.

The inward processing regime is carried out by obtaining a permit and is monitored by the provincial organization of the Ministry of Trade and exporters' associations until the goods are exported. In case of violation of the regime, heavy penalties are imposed under the Customs Law. For this reason, the goods included in the document and imported in this way are exported as a result of production, as well as being monitored on the record declared with a customs declaration during import and export, and kept under constant control by the customs administration and exporter associations.

A regulation allowing the delivery of products produced in the free zone to producers within the scope of the inward processing regime will not only facilitate the 85% export requirement but will also help reduce foreign dependency on exports and the current account deficit. These inputs are imported in any case for the production of the product to be exported. If the inputs are supplied from the free zone instead of being imported, there will be no foreign currency outflow from the country and a positive contribution to employment will be made.

SHOWING THE EAR BACKWARDS

Producers who want to benefit from the export support in the Free Zones Law export their products to meet the 85% ratio. After the exported product reaches the buyer abroad, it is sold to the producer in Turkey to be used as input under the inward processing regime. For example, after the product produced in the free zone is exported to Denmark, it is re-imported to Bursa. In this way, the producer in the free zone realizes the export, while the other producer imports the goods from Denmark. As a result, although the product produced in the free zone is exported in any case, the cost increases by adding export, import, freight, and insurance expenses and seller profits in addition to the price of the goods.

Isn't it “unnecessarily taking the hard way” to import the product produced in the free zone after exporting it, instead of giving it directly to the producer who will use it as input in the production of the goods to be exported?

To return from this unorthodox practice as soon as possible, I hope that a regulation will be made to allow the delivery of goods produced in the free zone within the scope of the inward processing regime as well as the delivery made to the free zones to be accepted “as a delivery deemed as export”.

- CAN A CITIZEN’S EXCUSE BE GREATER THAN HIS MISTAKE?

- Q&A ON GLOBALIZATION…

- INFORMATION SOCIETY, ARTIFICIAL INTELLIGENCE, AND TECHNOLOGICAL UNEMPLOYMENT…

- THE RISING AND RENEWING FACE OF EXPORT: e-EXPORT

- HOW IS THE DELIVERY OF AN ITEM TO THE IMPORTER PROVIDED?

- THE FUTURE OF GLOBALIZATION AND WORLD TRADE

- MINIVAN EXPRESS TRANSPORTATION: THE MOST IMPORTANT CHOICE FOR DUE DELIVERY

- THE WARRIOR SPIRIT AND MIRACULOUS POWER OF OLIVE OIL: POLYPHENOLS…

- TURKEY CORRUPT BETWEEN GLOBALIZATION AND PROTECTION

- EXPECTATIONS IN THE WORLD ECONOMY IN 2024…

- EXPECTATIONS IN THE ECONOMY IN 2024…

- PSYCHOLOGICAL RESILANCE…

- GLOBAL SUPPLY CHAINS ARE IN A DIFFICULT COLUMN

- DO ONLY BEES MAKE HONEY?

- HOW DO YOU IMPORT AN ITEM?

- WOMEN OF THE REPUBLIC OF TÜRKİYE WILL UNITE…

- COURAGE TO CHANGE...

- HOW DID I BECOME AN ASSISTANT CUSTOMS CONSULTANT?

- NEW DEVELOPMENTS AFFECTING GLOBAL TRADE…

- A NEW PARADIGM IN CUSTOMS IN A DIGITALIZED WORLD…

- 100TH ANNIVERSARY OF CUSTOMS…

- One Window…

- EXPECTATIONS IN CUSTOMS AND FOREIGN TRADE...

- PURCHASING AND SUPPLY MANAGEMENT

- EXCHANGE LEGISLATION IN TÜRKİYE…

- TRANSACTIONS CONDUCTED IN FOREIGN CURRENCIES…

- DIGITALIZATION AND LETTER OF CREDIT IN TRADE…

- TARGET OF THE BORDER CARBON REGULATION MECHANISM: INPUTS THAT CREATE CARBON LEAK…

- CARBON REGULATION AT THE BORDER IS IN FORCE…

- 100 YEARS IN THE FIGHT AGAINST SMUGGLING

- DIGITAL TRANSFORMATION IN CUSTOMS…

- BIG DIGITAL STEPS TAKEN IN CUSTOMS APPLICATIONS…

- SUPERFLUID ADDITIVES ARE INDISPENSABLE FOR CEMENT

- "TRUST AND RESPONSIBILITY" INDICATOR IN PERSONAL DATA MANAGEMENT

- NATURAL DISASTERS IN CUSTOMS LEGISLATION…

- UNMANAGED TIME IN THE MODERN WORLD

- THE IMPORTANCE OF DISASTER LOGISTICS

- THE LEARNING PROCESS OF THE POMODORO TECHNIQUE AND BEYOND

- 2022 AND AFTER IN TERMS OF LEGISLATION…

- A CHAOTIC YEAR: 2022

- FOREIGN TRADE AGENDA IN THE WORLD AND IN TURKEY AS WE ENTER THE YEAR 2023

- IS THE WORLD ECONOMY RUSHING INTO STAGFLATION OR RECESSION?

- HOW WILL THINGS BE CARRIED OUT IN THE LOGISTICS INDUSTRY DURING STAGFLATION?

- FOOD SUPPLY SECURITY POLICY IN FOREIGN TRADE

- STATEMENTS NOT AVAILABLE IN THE BILGE SYSTEM

- POSSIBLE EFFECTS OF RECESSION ON TURKEY...

- CARBON FOOTPRINTS IN CUSTOMS TARIFF

- UKRAINE-Türkiye WAR AND TURKISH ECONOMY…

- WAR AND FOOD SECURITY…

- WILL THE RUSSIAN-UKRAINE WAR TRIGGER A NEW ENERGY CRISIS?

- EFFECTS OF WAR ON TRANSPORTATION…

- A SPECIAL FIELD OF EXPERTISE: CUSTOMS CONSULTANCY

- WILL THE METAVERSE SEE US TOO?

- CUSTOMS CONSULTANCY AND PROFESSIONAL ORGANIZATION

- EVALUATION OF EXPORT REGISTERED SALES WITHIN THE SCOPE OF EMPLOYMENT SUPPORT IN FREE ZONES

- PRE-ARRIVAL CUSTOMS PROCEDURES

- INTERNATIONAL CUSTOMS PRACTICES IN THE FACE OF NATURAL DISASTERS

- ELECTRONIC LIQUIDATION

- BREXIT AND THE Türkiye-UK FREE TRADE AGREEMENT

- NEW CUSTOMS UNDERSTANDING

- CONTAINER PROBLEM

- TEN PERCENT FREIGHT THREE PERCENT INSURANCE

- DEDUCTION WITHOUT NAME: CULTURE FUND

- A LOOK AT THE ORIGIN OF GOODS IN THE NEW YEAR

- FAR EAST REGIONAL FREE TRADE AGREEMENT

- NEW IMPORT REGIME DECISION

- IS A COMMITMENT REQUIRED?

- IS SUPERMAN HUMAN?

- GUARANTEE

- FOREIGN TRADE TRENDS AFTER THE PANDEMIC

- Lump sum guarantee in warehouses

- ADDITIONAL CUSTOMS DUTIES – SMUGGLING RISK DILEMMA

- CHANGES MADE IN CUSTOMS PRACTICES AFTER COVID-19

- HOW DOES NATURAL GAS COME TO TURKEY?

- TEMPORARY STORAGE OF GOODS

- FINANCIAL LEASE

- RELATIONSHIP BETWEEN FOREIGN EXCHANGE LEGISLATION AND CUSTOMS PROCEDURES

- TRIANGLE TRAFFIC IN DETERMINING PRODUCT ORIGIN

- BORDER TRADE

- PAN EUROPEAN ORIGIN CUMULATION SYSTEM

- EXEMPTIONS AND EXCEPTIONS IN PRODUCT SAFETY INSPECTION

- QUOTA MANAGEMENT SYSTEM

- TRANSFER PRICING

- SUPPLIER DECLARATION

- CUSTOMS REGULATIONS REGARDING THE PROTECTION OF INTELLECTUAL AND INDUSTRIAL PROPERTY RIGHTS

- WRITTEN INFORMATION REQUEST ON CUSTOMS LEGISLATION

- CONTAINER TRANSACTIONS

- BLUE LINE APPLICATION IN EXPORT

- EFFECT OF PORT EXPENSES ON CUSTOMS VALUE

- PRE-ARRIVAL CUSTOMS PROCEDURES

- FUEL EXCISE TAX APPLICATIONS

- COMMITMENT CLOSURE IN OUTDOOR PROCESSING REGIME

- MONTREAL CONVENTION ON CIVIL AIR TRANSPORT

- COURIER TRANSACTIONS AND EMBASSY REPORTS

- FAST CARGO OPERATIONS

- CONSIGNMENT EXPORT

- THE RIGHT TO KUSAT

- SURVEILLANCE APPLICATIONS

- SPECIALIZED CUSTOMS APPLICATION

- GOVERNMENT AID IN FOREIGN TRADE PRACTICES

- IMPORT OF USED OR REFURBISHED GOODS

- LATEST SITUATION IN EXIMBANK SUPPORTS

- YYS AND OKS ADVANTAGES DISADVANTAGES

- COMMITMENT CLOSURE IN INTERNAL PROCESSING REGIME

- Returned Goods

- SHIP CONTROLS

- REGULATIONS RELATED TO HANDLING OPERATIONS

- STAMP DUTY ON FUEL GIVEN TO SHIPS

- WHAT IS ON-SITE CUSTOMS CLEARANCE IN IMPORTS?

- COVID-19 MEASURES IN TERMS OF CUSTOMS AND FOREIGN TRADE

- Bank Payment Obligation (BPO)

- CORONAVIRUS (COVID-19) RELATED MEASURES TAKEN IN THE FIELD OF TRANSPORTATION AND FOREIGN TRADE

- APPLICATIONS FOR INWARD PROCESSING AUTHORIZATION CERTIFICATE , INVESTMENT INCENTIVE CERTIFICATE AND GRANTED CREDITS

- THINGS TO PAY ATTENTION TO WHILE USING INCOTERMS

- INVESTMENT INCENTIVE CERTIFICATE

- What is the AEO Certificate?

- CONCERNING THE CERTIFICATE OF CUSTOMS APPROVED OPERATOR STATUS

- WHAT IS SPECIALIZED CUSTOMS? WHAT IS ITS IMPORTANCE?

- BLOCKCHAIN

- DECLARATIONS OF ORIGINS FROM SOUTH KOREA WILL BE REWIEVED

- WHERE DID THE DIGITAL SERVICE TAX COME FROM?

- INCOTERMS 2020 (International Delivery Terms 2020 Version)

- MINISTRY OF TRADE IN ITS FIRST YEAR

- US Exporters Race to Ship Soybeans as Looming Election Stokes Tariff Worries

- South Korea Economy Likely Returned to Growth in Q3: Reuters Poll

- India, US Sign Pact to Cooperate on Critical Battery Mineral Supply Chains

- DDG Ellard spotlights role of the WTO, current priorities

- EU Governments Face Pivotal Vote on Chinese EV Tariffs

- Dispute Panel Established Under the US Inflation Reduction Act

- UNCTAD’s Digital Economy Report 2024

- Goods Barometer Above Trend

- Unlocking the Value of OSINT in Customs Enforcement

- Coping with the Growing Challenges of Public and External Debt

- Carbon Emissions from Artificial Intelligence and Crypto on the Rise

- New Decision on Contracts from the Ministry of Trade!

- Europe Must Better Support Growth and Productivity

- Consumer Goods You Can Carry in Your Suitcase

- Breaking Barriers: How non-tariff measures affect women in e-commerce

- Artificial Intelligence Law Enacted in Europe

- Traveling with Your Pets in Europe

- New Sanctions on E-Commerce Sites From the Ministry!

- Tariffs on Critical Minerals

- WTO Secretary-General Addresses G7 Sector Stakeholders

- Four Ways to Protect Consumers in Tourism

- NEW PERSPECTIVES TO IMPROVE TRADE...

- New Agreement from the World Customs Organization

- Know Your EU Passenger Rights Before You Travel

- 2024 DIGITAL ECONOMY REPORT

- Global Trade Continues to Grow in the First Quarter of 2024

- EU Publishes Digital Transformation 2024 Report

- IMF Optimistic on Sovereign Debt Restructuring

- May Foreign Trade Data Opened

- Global Foreign Investors Dropped

- 2024 World Investment Report

- EU Increases Support for Ukraine's Recovery

- UN Trade and Development Organization Publishes 2023 Report

- Africa holds the Key to Sustainable Energy...

- Europe Must Increase Climate Action

- 4th Data and Statistics Meeting from WTO

- A Call from the UN Vice President for Trade and Development!

- Global Economic Disruption and Changing Investment Models

- Remarkable Visit from the United Nations!

- Geoeconomic Implications of Diversification in Foreign Trade

- Reflections of Global Crises on the Economy

- What Does the Critical Mineral Boom Mean?

- Strong Cooperation Move from the WTO!

- What Will Trade Growth Look Like in 2024?

- 20th Anniversary of EU Enlargement

- The Effects of Trade Growth...

- WTO Asia-Pacific Conference of Heads of Customs Administrations Concluded

- Central Bank Strengthening is a Must!

- Saudi Arabia Supports Global Supply Chain Forum

- Türkiye's Share of World Exports Increased!

- World Happiness Report Published

- Bulgaria and Romania Join the Schengen Area

- February Foreign Trade Data Announced

- What Does the Future Hold for Global Trade?

- Global Trade Update from UNCTAD

- Countries that Achieve Gender Equality Win!

- Accident at Kocaeli Evyap Port!

- New Step in Free Trade Agreement!

- Goods Barometer Continues to Signal

- Red Sea Attacks Disrupt Global Trade

- Campaign for Equality, Diversity and Inclusion in Customs Launches

- EU Prepares its Digital Infrastructure for Tomorrow's World!

- Türkiye's Importance in Logistics Increases!

- The New Formation of the Digital Age 'Metaverse'

- Energy Demand Creates Pressure!

- New Economic Forecasts from the European Union!

- Global Economy Transitions to Soft Landing, But Risks Remain

- Global Trade Disruptions Sound the Alarm!

- LNG Imports Increase by 3.4 Percent in 2023

- Emerging Markets Lead Global Interest Rate Volatility

- Foreign Direct Investment in Emerging Economies Declined

- World Economic Forum 2024

- Home Buying Declines in High-Interest Rate Environment

- Turkish Economy Continues to Grow!

- Data Law Comes into Force in the EU

- The EU Abolishes Borders!

- Points to Consider in Fast Shipping Transactions

- How is Digitalization Changing Trade?

- UNCTAD Report Reveals Untapped Potential of Trade in Climate Action

- Global Trade Patterns Become Geopolitical

- International Trade and Green Hydrogen Supporting the Global Transition to a Low Carbon Economy

- How Developing Countries Can Keep Up with the AI-Driven Digital Economy

- What is Perishable Food Transportation?

- Trade Deal to Connect Turkey to Europe Sıgned

- Central Bank Enters New Phase of Digital Currency Development

- Goods Barometer Shows Trade Volumes Returning to Trend Amid High Uncertainty

- Outstanding Collaboration Award from HUAWEI to ÜNSPED

- Least Developed Countries Report Published

- Turkish Investment Fund Bill was Accepted

- ITF Publıshes 2023 Transportatıon Report

- While Natural Gas Imports Decreased by 4.5 Percent, Oil Imports Increased

- The Need for Storage Space is Increasingly Increasing

- 9 Advantages of Pre-Arrival Clearance

- What is Customer Work Portal (CWP)?

- Energy Management System

- Compliance Management System

- UGM, ISO 27701 Personel Information Management System

- Logistics and Supply Chain Management

- We are at your service with our 3000 square meter Free Warehouse at Istanbul Airport for Your Export Transactions

- We were deemed worthy of the Sustainable Business Award with our Sustainable Agriculture Project

- Global Trade Consulting

- What Does Unsped Bring to You?

- More than an audit: Smart Inspector

- Risk Management System

- UGM Chemistry Laboratory Accredited.

- Our company Ünsped Customs Consultancy is a member of UN Global Compact.

- From the President of Fisheries Subsidies

- IMF Executive Board Approves Quota Increase

- How Training and Consulting Can Accelerate Cross-Border Payments and Reduce Costs

- Türkiye Increased Exports in 2023

- British Importer Will Buy Cat Litter from Türkiye

- Global Gateway Project from the EU in response to China's

- The Private Financing Need of Developing Economies is Increasing

- 5.5 Million Dollar Incentive for Exports from Foreign Trade Intelligence Centers

- The EU is Carrying Out Customs Reform.

- Transformation Project in 19 Logistics Centers

- Penalty for Exorbitant Prices and Hoarding from the Ministry of Commerce!

- Why is Customs Inspection Important?

- Amazon Opens Its First Logistics Center in Türkiye

- Are Emerging Technologies Disruptive?

- What is the Customs Tariff Schedule?

- Potential E-Export Market

- How to Become a Customs Consultant?

- Use of EORI Number by Carrier Companies in Transportation to the EU

- Step by Step Import and Export Business Processes

- Foreign Trade Data for August 2023 Announced

- Authorized Economic Operator Certificate (YYS)

- ETGB (Electronic Commerce Customs Declaration) Services

- Transactions and Processes in Import Customs

- Dünya Ticaret Örgütü 2021 Raporu

- UNCTAD Deniz Taşımacılığı Raporu 2021

- Supplier Sustainability

- Green Check – Green Check Certification

- ÜNSPED Customs Consultancy and Logistics Services Inc. Ranked 50th in the

- Your Transactions are Easier at Customs with Fabric and Yarn Detail Information Forms

- We have been at your service in International Customs and Logistics for 43 Years.

- As of July 2023, "Safety Information Form" is being prepared at Ünsped Customs Consultancy.

- Ünsped Customs Consultancy Has Become The Solution Partner Of AEB in Türkiye.

- The Rise of Africa as a Global Supply Chain Power: UNCTAD Report

- Digital Era in Foreign Trade

- EU Prepares to Investigate Some Turkish-Origin Steel Products

- World Economic Outlook 2023 July Report

- India and USA Mutually Resolve Six Trade Disputes in WTO

- Ministry of Commerce to Increase Export Support in 2024

- A New Commercial Era Begins Between Türkiye and the EU

- WORLD INVESTMENT REPORT 2023

- Pazarkule Border Gate Opened

- New Cooperations Between Türkiye and United Arab Emirates

- 2023 Strategic Foresight Report: Sustainability and Prosperity at the Center of Europe's Open Strategic Autonomy

- Support for E-Export from the Ministry of Commerce!

- Earth Overshoot Day Warning

- Türkiye Achieved Successful Results in COST Participation

- WTO publishes new edition of World Tariff Profiles

- Joint Statement from Türkiye and the United Kingdom on the Free Trade Agreement

- Our Third Extended Executive Board Meeting of 2024 was Held

- Presentation Ceremony of ISO 27701 Personal Data and Information Privacy Management System Internal Auditor Training Certificates

- The Second 2024 Extended Executive Board Meeting Was Held

- NEXEN TIRE Preferred ÜNSPED Customs Consultancy and Logistics Services Inc.

- UGM's 2024 General Assembly Meeting was Held

- We Promise What We Can Do, and We Definitely Do What We Promise

- Ms. Leyla ALATON and Prof. Dr. Emre ALKİN Provided Unforgettable Moments to the Participants at Our 15th Customer Advisory Board Meeting with His Enjoyable Conversations

- We added our customers' expectations and evaluations to our decision processes at our 15th Customer Advisory Board Meeting.

- UGM's 15th Customer Advisory Board Meeting was held with the theme of "Trade Facilitating Practices".

- Digitalization in Supply Chains, hosted by Istanbul Chamber of Commerce (ITO); Risks and Opportunities in Trading Seminar

- We participated in the "Sixth World Customs Organization (WCO) Global AEO Conference" together with the Authorized Economic Operator (AEO) Association.

- We Held Our 2024 First Management Team Meeting with the Theme of Leading Change & Transformation

- This Week in Our Trademark Course on Customs Regulation and Operations

- The valuable works of our winning Ünsped children were exhibited at an art fair for the first time.

- April 23 Paintings of OvooArt Special Award Winners, Drawn by ÜNSPED Children, are Exhibited at Izmir Art Fair İZFAŞ.

- We were at the Istanbul Technical University "Twin Transformation" Summit

- UGM Ankara Regional Directorate Severance Presentation Ceremony

- Visit to Ankara Chamber of Industry (ASO)

- The Success of Our National Athlete

- Our Paratriathlon Athlete Uğurcan Özer was at ÜNSPED

- Interview with Kabataş Boys' High School Young People

- Sufism and Turkish Music Concert by the Universal Mevlana Lovers Foundation (EMAV)

- UGM Aegean Regional Directorate Severance Presentation Ceremony

- Customs Regulation and Operations Themed Trademark Courses Continue

- Interview on "Personality Types and Awareness Training"

- We Participated in AEB's "Business Stakeholders Meeting"

- Our 4th Traditional Ünsped Children 23 April Painting Contest has been concluded

- We Met with our Board and Committee Presidents at the Iftar Dinner

- Our Conversation on "Body Language" was Held

- Customs Regulation and Operations Themed Trademark Lectures started.

- Our guest within the scope of the enlightenment meetings was Mr. Timur ERK, President of the Türk Böbrek Vakfı

- 8 March International Women's Day at ÜNSPED

- We have left behind the first week of the Customs Consultant and Assistant Consultant Preparation Course

- We enthusiastically congratulate our Operations Team Leader, Ms. Neslihan PEKYILMAZ.

- UGM Çukurova Regional Directorate Severance Presentation Ceremony

- 932 Colleagues Gained Awareness of Basic Disaster Awareness in 31 Sessions

- Our Company Partner Visited Our Kayseri Branch

- Nasıl Bir Ekonomi Editorial Board Chairman Dr. Interview on "Body Language" by Şeref OĞUZ

- Our training on "Ethical Principles and Business Ethics" was held.

- Our Extended Executive Board Came Together at the Strategy Workshop

- We Asked Someone Who Knows, The Third of Our Meetings Took Place

- Visit to UGM Aviation Directorate

- We Have Left Behind the First Week of Our "Applied Customs and Foreign Trade Expertise" Certificate Program

- We Made Our Presentations Titled "Purchasing" and "Last 2 Years in Border Carbon" within the Scope of Turquality Training Program.

- We were at the launch of the O-Asistant application hosted by O-Asistant & Cancer-Free Life Association

- Nasıl Bir Ekonomi Editorial Board Chairman Dr. Interview by Şeref OĞUZ on "Attention and Concentration in Business Life"

- Our "Disaster Awareness Training" was carried out.

- We commemorated the February 6th Earthquakes at UGM.

- We Met with Our Board and Committee Chairmen

- We Met with UGM Eastern Thrace Regional Directorate Employees

- We Celebrated World Customs Day at UGM

- We were at the Istanbul Chamber of Industry.

- Our Guest within the Scope of Enlightenment Meetings was Ms. Çağla Çabuk

- We would like to thank AFAD for the Basic Disaster Awareness Awareness Trainings.

- Our guest within the scope of enlightenment meetings was Mr. Türker ERTÜRK

- Nasıl Bir Ekonomi Editorial Board Chairman Dr. Interview by Şeref OĞUZ on "Motivating Yourself"

- Our Panel on Foreign Trade and Customs Legislation 2024 Changes Was Held

- We Said Hello to the New Year with Our Lucky Bracelets

- Trakya University Students were at ÜNSPED.

- We said hello to the Second Century of our Republic with the Strong Business Model We Established and the Projects We Implemented.

- New Year's Eve Dinner at our UGM Aegean Regional Directorate

- We Asked Someone Who Knows, The Second Meeting of Our Meetings Took Place

- Award Ceremony at our UGM 42nd Traditional Year-End Evaluation Meeting Held with the 100th Anniversary Theme

- We Held Our UGM 42nd Traditional Year-End Evaluation Meeting

- First Aid Training was Given.

- Our Organization Was Held in the Traditional Management Kitchen

- Interview by Nasıl Bir Ekonomi Editorial Board Chairman Dr. Şeref OĞUZ on ''Skill Management''

- We were at the Career Talk Event.

- Within the scope of our enlightenment meetings, our guest Mr. Şenol Cıravoğlu.

- Mersin Chamber of Commerce Chairman of the Board of Directors, Mr.Sefa Çakır, visited our stand at Mersin Logistics and Transport Fair.

- Our Emergency, Evacuation and Fire Extinguishing Drill was Held at Our Headquarters

- ITU Textile Engineering Club and Branding Students Club were at ÜNSPED.

- We Celebrated the 10th Anniversary of our ÜNSPED Development Academy on November 24th, Teachers' Day.

- We Asked Someone Who Knows, The First of Our Meetings Took Place

- Outstanding Collaboration Award from HUAWEI to ÜNSPED

- Interview by Nasıl Bir Ekonomi Editorial Board Chairman Dr. Şeref OĞUZ on Training the Trainer

- Our company ranked 5th in the 'Consultancy, Consultancy and Support Services' category in the 2022 Service Export Champion Evaluation.

- Our Guest within the Scope of Enlightenment Meetings was Mr. Mahmut ÇELİK

- Commemoration of Our Atatürk Concert at UGM

- We commemorated the Great Leader Mustafa Kemal Atatürk on her 85th Anniversary.

- We Held Our Fourteenth Customer Advisory Board Meeting

- Our Guest within the Scope of Enlightenment Meetings was Mr. Emre Hantaloğlu

- We Celebrated the 100th Anniversary of our Republic with Endless Enthusiasm and Love.

- Interview by Nasıl Bir Ekonomi Editorial Board Chairman Dr. Şeref OĞUZ on

- Seminar on Chemical Registration System and Chemical Registration Obligations within the scope of KKDİK

- Our Training on the Personal Data Protection Law was Held.

- İstanbul Valisi Sayın Davut GÜL'e Ziyaret

- Our guest within the scope of enlightenment meetings was Mr. İlhami EKSİN

- Year 2023 III. Extended Executive Board Meeting Held.

- We Took Our Place at the Branding Summit Organized by Istanbul Technical University on 18-19 October

- Our Seminar on Customs Procedures in Civil Aviation was Held.

- The signing day of the book called The Devil's Violinist was held at our Aegean Regional Directorate

- Our Awareness Training for Parents to Prevent Child Neglect and Abuse was Held

- We Came Together with Our

- Technological Support to Ümraniye Atatürk Vocational and Technical Anatolian High School

- ÜNSPED Team's First Match and First Win at Business Cup Istanbul

- We Listened to the Activities of the Turkish Cancer Association in Our Disclosure Meetings

- The guest of our enlightenment meetings is former national team volleyball player Mr. Esra GUMUS

- Within the scope of the Enlightenment Meetings, our guest was Dr. Berk Çağdaş

- Nasıl Bir Ekonomi Editorial Board Chairman Interview by Dr. Şeref OĞUZ on

- We Held Our 19th Management Team Meeting

- We Met with Our National Catering Services Company

- Visit to the Chairman of the Board of Directors of Ankara Chamber of Industry

- Our Search, Rescue, Evacuation and Earthquake Training Continues at Full Speed

- We have left behind the first week of our

- Interview with Dr. Naim Babüroğlu on Atatürk and the Republic

- The Guest of Our Lighting Meetings, Painter Mr. Pınar Tuba was BİÇMEN

- The Fifth of Our Free Chair Themed Communication Meeting Was Held

- Victory Run in the Footsteps of Our Ancestors on August 30

- The Fourth of Our Free Chair Themed Communication Meeting Was Held

- What is Artificial Intelligence? What is not? Our seminar was held.

- Cooperation between our Ünsped Gelişim Academy and Düzce University Employment Program

- The Third of Our Free Chair Themed Communication Meeting Was Held

- We had pleasant moments with the little ones who came to visit their parents in our company.

- The Second of Our Free Chair Themed Communication Meeting Was Held

- The First of Our Free Chair Themed Communication Meeting Was Held

- Our Rowing Sports Organization Was Held

- Our Lunch Meetings with Our Interns Continue.

- Ünsped Customs Consultancy Has Become The Solution Partner Of AEB in Türkiye.

- Celebration in Our Chemistry Lab

- Year 2023 UGM II. Our Extended Executive Board Meeting Was Held

- Zero Waste Management Awareness Training Held at UGM

- We came together for lunch with our interns.

- We are at the 19th Asian Chemistry Congress

- We were at the Advisory Board Meeting Organized by Istanbul University Faculty of Economics

- Congratulations to Our Graduate Employees

- Daily Nature Trip in Polonezköy

- Hello to Summer Once Again with Ünsped!

- Our 3rd Traditional Unsped Children's April 23 Painting Contest has concluded.

- Nasıl Bir Ekonomi Editorial Board Chairman Dr. Şeref OĞUZ An Interview with on

- Seminar on “The Possible Effects of the Green Agreement on Our Foreign Trade” in cooperation with the Energy Industrialists & Businessmen Association

- UNSPED Achievement and Performance Awards were presented at our Headquarters.

- We have been awarded the Supplier Sustainability Evaluation TEDPORT Certificate

- Our Company Partner Met with Our Gaziantep Branch Employees.

- An Interview with Nasıl Bir Ekonomi Editorial Board Chairman Dr. Şeref Oğuz on ''The Art of Public Speaking & Effective Presentation''

- Third Motivation Meeting Held

- Our Motor Courier Team Completed Safe Driving Training

- Standard Management System and Work Activities Launch at UGM

- 19 May Commemoration of Atatürk, Youth and Sports Day Celebration & Flag Delivery Ceremony at UGM

- Örsçelik Balkan Artificial Intelligence Competition Final Presentations and Award Ceremony Was Hosted by Our Company.

- Ünsped Women's Leadership Development Committee Visited Anıtkabir

- Our Employee Communication and Workplace Happiness Committee Celebrated Our Employees' Day of Love.

- Authorized Economic Operator Certificate Delivered to Peker Surface Designs Industry and Trade Inc.

- Galatasaray Day in Ünsped

- 2023 General Assembly Meeting Held

- 'International Marketing and Target Market Selection' training was held

- We Held Our 2023 UGM Management Team Meeting

- Thank You Plaque To Our Ünsped Customs Consultancy Company

- What Kind of an Economics Editorial Board Chairman Dr. An Interview with Şeref OĞUZ on "Communication with Difficult People"

- We Came Together with Our Yalova Branch Employees

- We Held the Thirteenth of Our Customer Advisors Board Meeting

- 23 April Painting Contest Awards at ÜNSPED Found Their Owners

- Youth Summit in Foreign Trade and Logistics at UGM on the 100th Anniversary of the Founding of our Republic

- Ünsped Customs Consultancy and Trigon Yazılım A.Ş.

- Presentation of Seniority Certificates to Our Employees Who Have Completed 5 Years at our Headquarters

- Visit of Korean Students to Ünsped

- Our Çukurova Region Employees Visited Our Ünsped Tarım Company with their Families

- ''Applied Customs and Foreign Trade Expertise'' certificate program started again

- 2023 / UGM I. Extended Executive Board (Strategy Workshop)

- ÜNSPED Awards were presented at our Headquarters

- Presentation of Seniority Plaques to Our Employees who have completed their 10th, 15th, 20th and 25th Years at our Headquarters

- World Customs Day Seminar at UGM

- An Interview with Dr. Şeref OĞUZ on Problem Solving and Decision Making

- Interview on “Organizational Siloing”

- Mother's Day Excitement in Ünsped

- Benefits of Transfer Pricing for Companies and Taxation Seminar Held

- Celebration with the Team of Our UGM Chemistry Lab

- What Kind of an Economy Editorial Board Chairman Dr. Interview by Şeref OĞUZ on "Communication with Difficult People"

- Training on Sales Management in the Corporate Market was Held

- Basic Competencies Program at ÜNSPED

- At the Hello Week Meeting; 23 April National Sovereignty and Children's Day Breeze

- Second Motivation Meeting Held

- We Celebrated 8 March International Women's Day of Our Employees

- We Came Together with Our Tuzla Branch Employees

- Traditional meeting at our Ünsped Sports and Culture Club

- We Came Together with Our Aegean Regional Directorate Employees

- Scientific Education is Among Our Indispensables

- The First of Our Motivation Meeting Was Held

- What Kind of an Economics Editorial Board Chairman Dr. An Interview with Şeref OĞUZ on “Sustainability”

- To Good, Right and Beautiful with Team Spirit

- Our 2023 Basic Customs and Foreign Trade Legislation Seminar Was Held.

- Ünsped Social Responsibility Committee Awarded Turkish Cancer Society Award

- Our Training on “Sectoral Methods in Tariffs: Electronics (85. Chapter)” Was Held

- New Year's Concert at UGM

- UGM 41. Traditional Year-End Evaluation Meeting

- We Came Together with Yeditepe University Students.

- What Kind of an Economics Editorial Board Chairman Dr. An Interview with Şeref OĞUZ on

- The Guest of Our Lighting Meeting was Ms. Zeynep Hilal ÇELİK

- Launch of UGM Chemistry Laboratory, which has successfully completed the Accreditation Process

- Letter of Credit Education at Celal Bayar University

- Sectoral Methods in Scheduling: Mechanics

- Blood Donation

- New Year's Eve Dinner in Antalya Branch

- Search, Rescue, Evacuation and Earthquake Training

- Strategic Communication and Reputation Management Summit at UGM

- Our guest at the Lighting Meeting, Prof. Dr. Korkut ULUCAN

- We Attended the Sustainability and Zero Waste Fair and Congress

- 24 November Teachers' Day Celebrated for the Trainers of our Ünsped Gelişim Academy

- Cap Ceremony at UGM

- Our Guest at Our Lighting Meeting was Herbalife Wellness Coach Ms. Taliye ALPER

- We were at the 31st Quality Congress.

- First Aid Trainings at UGM

- We Held the Twelfth of Our Customer Advisors Board Meeting

- The Art of Listening by Honorable Şeref OĞUZ, Member of the Editorial Board of Dünya Newspaper

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK Gathered for Lunch with Our Colleagues and Managers Interested in Huawei Turkey

- Our Ata Commemoration Concert at UGM: We Remember Our Ata with His Favorite Songs

- Visit to the Chairman of the Konya Chamber of Industry

- We Respectfully Commemorate the Great Leader Atatürk on His 84th Anniversary

- Our Organization took place in the Traditional Management Kitchen.

- Ataköy Rotary Club Visited Our Company

- Ünsped Customs Clearance Pursued Goodness

- Our Emergency, Evacuation and Fire Extinguishing Drills were Held at our Headquarters

- We were at Huawei Turkey Business Partners Conference

- Training on

- Celebration at Our Aegean Regional Directorate

- Awareness Seminar: The Real Face of Cigarettes

- Aydınlatma Buluşmasında Misafirimiz Sn. Yasemin ERKAYA'ydı

- Year 2022 UGM III. Our Extended Executive Board Meeting Was Held

- Techniques for Preparing R&D and Innovation Projects

- Within the scope of the Lighting Meetings, our guest was Mrs. Aslı Hatice ERSOY.

- Our Ünsped Sports and Culture Club was our guest at our Hello Next Week Meeting

- Our Ünsped Sports and Culture Club was the guest of our Lighting Meetings

- We Met With Our R&D Department at Lunch

- Inward Processing Regime Themed Seminar Took Place

- II. We were at the Military Logistics and Support Summit

- Within the Scope of Our Illumination Meetings, Our Guest was the Turkish Cancer Society

- Our National Paralympic Athlete Muhammed Ali AYDIN was our guest at our Hello Week Meeting.

- Farewell Party to Summer at ÜNSPED

- Within the Scope of Our Lighting Meetings, Our Guest was Sıddıka Semahat DEMİR

- Gender Equality Perception in Advertisement and Prejudges Themed Seminar Took Place

- Within the Scope of Our Lighting Meetings, Our Guest was Tamer LEVENT

- Young Generation Leadership Development Committee Visited ÜNSPED Tarım Received Sustainability Award

- We Held Our 17th Management Team Meeting

- Seminar on Upgrated Export and e-Export-Oriented Government Supports

- The Contribution of Art to Young Generations Themed Enlightenment Meeting was Performed

- We were at the World Automotive Conference

- Lunch with Ünsped Young Generation Leadership Development Committee Members

- ''Applied Customs and Foreign Trade Expertise'' certificate program started again

- Lighting Gathering on the Role Model Perception and Communication of the Young Generation

- We were at the Automotive Innovation Summit

- We Met Again with Istanbul University for our Online Applied Customs and Foreign Trade Specialization Program

- Special Dental Screening Service of Medipol Hospital for Our Employees

- We have listened to the Public Police Officer Nuray TOPRAK from the Turkish Police Department

- Our Retired Employee, Plaque of Appreciation to Mr. Akın ÖZTAŞKIN

- We Congratulated Our Graduate Employees In Our Ankara Region

- Congratulations to Our Graduate and Graduate Employees

- We thanked our company for the importance it has shown to Occupational Health and Safety within the scope of the TSE COVID-19 SAFE SERVICE CERTIFICATE,

- Congratulations to Our Employees

- Our Employees Have Been Informed About Complementary Health Insurance

- Within the Scope od Preparation to GMY Exam, "Entrance into Free Circulation, End-Use, Post and Quick Cargo, Smuggling Secondary Legislation" Education was Performed on 15 September 2018

- Personal Development Training: Marketing and Communication Techniques

- We Came Together with Our Employees at our Ankara Regional Directorate

- Mail and Express Cargo Transactions Webinar

- Turkish Women from the Point of View of Mr. Erdoğan ARIPINAR themed Enlightenment Meeting took place

- Audits Started for the Accreditation of Our Chemistry Laboratory

- We were One of "The first 500 Companies of Turkey which Performed the Highest Number of Service Exports"

- Southern Marmara Region Seniority Plaque Certificate Presentation Ceremony

- Dünya Göz Hospital Was Our Guest Within The Scope Of Our Lighting Meetings

- We Completed Our Education at Işık University with CO-OP Collaboration

- We Evaluated Industrialist-Logistics Stakeholders and Encountered Problems in TURKTRADE's Panel

- ÜNSPED’s Children at Ovooart Art Gallery

- Webinar in cooperation with Italian Chamber of Commerce and Industry Association & UGM

- Anıtkabir Visit of Our Young Generation Leadership Development Committee

- Eleventh of Our Customer Advisory Board Meeting Realized

- Lunch with Ünsped Sports and Culture Club Volleyball Team

- We Met Our Interns for Lunch

- We Came Together with Our Çukurova Regional Directorate Employees

- The Online Applied Customs and Foreign Trade Specialist certificate program, which offers JOB OPPORTUNITIES, has started again

- We Came Together with Our Employees at our Aegean Regional Directorate

- Personal Data Protection Committee Completed Its Training Under ISO 27701

- ‘’Customs Warehouse and Temporary Import Regimes and Applications’’ at Işık University

- 2022 General Assembly Meeting Held

- Our Children Painted The Republic

- We were at Atılım University

- Awareness Day at UGM: Be Aware, Don't Disrupt Health Checks

- Our Trainings Continue in Cooperation with Işık University & UGM

- Webinar in cooperation with the Automotive Suppliers Association of Turkey (TAYSAD) & UGM

- Visit to the President of the Turkish Republic of Northern Cyprus

- Professional Development Training: ''Effective Trainer Presentation at UGM''

- 16th Management Team Meeting at UGM

- Electronic Applications in Business Processes

- 2022 Seniority Plaque and Certificate Presentation Ceremony of Our Employees

- We Celebrated 8 March International Women's Day for Our Female Employees

- UNSPED Leader Women's Summit

- Step by Step Export Online Customer Meetings in cooperation with UGM & QNB Finansbank

- Export Regime and Practices Course in Collaboration with Işık University & UGM

- We were at the 10th International Aluminum Symposium on March 3-4

- HAYHAK Animal Rights Club was the guest of our Lighting Meeting

- Altınbas University & UGM Signed Protocol for Customs Legislation and Operation Course

- Seniority Plaques and Certificates Presented to Our Employees at Çukurova Regional Directorate

- 4th Week In the training Online Applied Customs and Foreign Trade Expertise.

- Our Guest was Ümit Erdem within the Scope of our Enlightenment Meetings

- A Workshop themed “Customs Tariff Implementation and Classification Legislation” was Actualized within the Structure of Ünsped Development Academy (UGA) under Cooperation of UGM and German-Turkish Chamber of Industry and Trade

- UGM Strategy Workshop Held Its First Meeting This Year

- The First Phase of the Turkish Foreign Chain R&D Project has been completed

- Our Volleyball Team, competing in the 2nd League is the Istanbul Champion

- ÜNSPED Customs Consultancy and Logistics Services Corporation, Unsped Development Academy UGA and Kocaeli Chamber of Industry Cooperation Seminar on "Customs Tariff Application and Classification Legislation"

- We Celebrated February 14 Valentine's Day with Our Employees

- Our Training on “Business and Project Development Strategies” Took Place

- Our Training on “Internal Processing Regime and Applications” Took Place

- This Week in “Applied Customs and Foreign Trade Expertise” Certificate Program

- Tariff Specialization Trainings Took Place

- We have Created Awareness with Colorful Masks on World Cancer Day

- Happiness Day in ÜNSPED

- Webinar in Cooperation with Southeastern Anatolia Exporters' Associations (GAIB) & UGM

- The Strength of Our Company Comes from Our Employees who Work Together for a Common Cause

- Webinar in Cooperation with the Association of Vehicle Supply Industrialists (TAYSAD) & UGM

- Within the scope of our Disclosure Meetings, we discussed the topic “Ways to Provide Social Gender Equality by Breaking the Lock”

- Poetry Show at UNSPED

- The Certificate Program

- The Panel titled “Business People under the Woman Leadership”, the Common Activity dated March 7, 2018 of Ünsped Customs Brokerage, Woman Leadership Development Committee&Altınbaş University&Social Gender Equality and Woman Studies Research and Applicatio

- Certificates of Success were presented to the Senior Men's Team of our Unsped Sports and Culture Club

- Certificates of Gratitude were presented to Our Employees who have Achieved Success and High Performance in the Aegean Region

- Up-to-Date Information on the Foreign Trade Legislation and Communiqués Related to the Implementation of the Import Regime Resolution of 2022

- Up-to-Date Information on the Foreign Trade Legislation and the Communiqués Issued for the Implementation of the Import Regime Resolution of 2022

- A Volleyball Team of our Ünsped Sports and Culture Club was presented with a Committee Special Award

- R&D, Customer Satisfaction and Committee Special Awards Found Their Owners

- Training on Inward Processing Regime Legislation and Practices

- "Government Aids for Export and Payment Methods in Foreign Trade" Webinar

- Within the Scope of Our Lighting Meetings, Our Guest was Mutlu ALKAN

- Our Company Partner, Yusuf Bulut ÖZTÜRK Presented Certificates of Appreciation to Our Employees for their Success and Performance

- Our Customs and Foreign Trade Trainings Have Been Held

- Our company ÜNSPED Gümrük Müşavirliği ve Lojistik Hizmetler A.Ş. is Service Export Champion of 2020

- Our Unforgettable Employees

- We aim to constantly innovate and develop

- Committee Special Award Presented to Our Suppliers

- The strength of our company comes from our employees who work together for a common purpose

- 2021 ÜNSPED Awards Found Their Owners.

- Honesty and Transparency Are Our Principle

- Our 40th Annual Year-end Assesment Meeting was held with the theme of

- Webinar on ''Customs and Foreign Trade Analysis of 2021''

- Beykoz University Students Visited Our Company

- The Effects of Climate Agreement and Green Agreement on Our Foreign Trade Webinar in TAYSAD & UGM Cooperation

- Giving Development Opportunity To The Young Generation: To Talk About Development Of Young Talent And Individual Leadership Topic, The Managing Partner And PWN Istanbul Secretary General İn ASO Company Aylin SATUN OLSUN was Our Guest.

- Taha Nusret BOZKURT was the guest of our Lighting Meeting themed

- Customs Practices in Foreign Trade Seminar at Istanbul Gelişim University

- Quality Management Systems Basic Training Was Conveyed to Our Employees

- Tariff Schedule Analysis within the Scope of 2022 Changes

- The Effects of the Climate Agreement and the Green Agreement on Our Foreign Trade

- We were at the Military Logistics and Support Summit on 7-8 December 2021

- "Welcome to Our Voice" Celebration for Our Deaf Employee Burçin EKMEKÇİ

- We met at lunch with our students who successfully completed our Applied Customs and Foreign Trade Expertise Training Program

- ÜNSPED Customs Consultancy and Logistics Services Inc. held a seminar titled "E-Invoicing at Exports" in cooperation with Ünsped Development Academy UGA and Kocaeli Chamber of Industry.

- I. Session of the Webinar on Investment Incentive Supports Was Held

- We implemented our emergency and evacuation practice of 2017

- ''Art is Everywhere'' We Celebrated World Violin Day at UGM

- Certificates Within the Scope of ISO 9001:Quality Management System Internal Auditor Training Found Their Owners

- We Are Proud To Register The 1 Millionth Declaration

- Seminar On Customs Practices in Foreign Trade

- They Pedaled Against Obstacles

- A Futsal Match for the Visually Impaired Took Place on December 03, Disability Day

- We Drew Attention to the December 3rd, World Day of People with Disabilities

- As part of the Enlightenment Meetings, our guest was ASLI OTHAN TANIR of Sevgili Bebek Company

- Thanks to Unsped Customs Brokerage and Benjamin Button Women's Group for Their Support

- We have been awarded the

- Certificate of Gratitude to our South Marmara Regional Directorate

- November 24th, Teachers' Day of Our Instructors Celebrated

- Webinar on Possible Effects of the Climate Agreement and the Green Memorandum on Our Foreign Trade in Cooperation with SCC & UGM

- Within the Scope of Enlightenment Meetings, Our Guest was Zeynep Nihan YILDIZ from Yiğit AKÜ A.Ş.

- We Held the Tenth Meeting of the Board of Customer Advisors

- We attended the Webinar on “Are There Solutions on the Horizon for Foreign Trade Logistics?

- Our Courses are over in our Certified Education Program in Cooperation with Istanbul University, Our Students Are Waiting for the Excitement of the Exam

- Atatürk Memorial Concert at UGM: We Commemorated Atatürk with the Songs He Loved

- We Respectfully Commemorate the 83rd Anniversary of the Pass Away of the Great Leader Ataturk

- Ankara Regional Directorate's Visit to Anıtkabir

- Internal Audit Training at UGM

- Our Traditional Activity-Directors in the Kitchen

- Our Lighting Meeting Themed

- Republic Day Painting Contest

- On Pink Ribbon Wear Day, We Said That We Are Aware We Are Not Afraid

- Our Certified Training Program in Cooperation with Istanbul University Is Continuing

- Our Extended Executive Board Meeting Was Held

- Our Communication Workshops Have Begun

- Ergonomics Hour at the Office

- Our Webinar on Safety and Security Measures in International Trade Took Place

- Our Certificate Program ’Applied Customs and Foreign Trade Expertise

- Our Applied Customs and Foreign Trade Specialization Certificate Program has Started.

- Autograph Session at UGM

- The ''5th of ''We Are A Team Trip'' Strengthening our Friendship was done to Town of Springs, Maşukiye

- II. Our Management Team Meeting Was Held

- We Support Our National Athletics Team

- The Webinar on the Turkey-United Kingdom Free Trade Agreement took Place.

- Ünsped Customs Consultancy Has Made a Novelty in Its Sector by Opening a Chemical Laboratory

- We acted on the principle of “our responsibilities to society and humanity”

- Lunch with Future of our industry; Our Interns

- Our Occupational Health and Safety Trainings are continuing in our Head Office and Branches

- Visit To Our Kocaeli Regional Directorate

- In cooperation with the German Turkish Chamber of Commerce and Industry (AHK)

- The Book Of Spiritual Leadership Is Published

- This Year, Women's Day was on the 6th of March

- Certified Training Program with Istanbul University

- We met our interns at lunch

- Training On “Personal Data Protection Law”

- "The Joy Of Eid Al-Adha" In Unsped

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK Met Our Interns For Lunch.

- Webinar on Changes in Investment Incentive Legislation No. 4191 was Held.

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK visited our Ankara Regional Directorate.

- Turkey-UK Free Trade Agreement Webinar was Held

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK visited our Aegean Regional Directorate.

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK visited our South Marmara Regional Directorate.

- Our business partner Araymond received

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK visited our Kocaeli Regional Directorate.

- In Collaboration with UGM & TAYSAD

- In Collaboration with UGM & Centrum Turkey

- Within the Scope of Lighting Meetings, Our Guest was Company's Doctor, Mr. Yücel ŞENGÜN

- Our Webinar themed as Freight Declaration in Customs Value Was Held

- Uğurcan ÖZER is at Ünsped

- Plaque to Our Company from the Association of Quality Union

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK visited Our Ankara Regional Directorate.

- Our Webinar themed as Pre-Arrival Customs Clearance Was Held

- The guest of our Lighting Meeting was Timur ERK.

- Our Company Partner Mr. Yusuf Bulut ÖZTÜRK visited Our Kocaeli Regional Directorate.

- Our ÜNSPED Employee Communication and Workplace Welfare Committee Celebrated Father's Day of Our Employees

- A Seniority Plaque and Certificate Presentation Ceremony was Held to Our Employees in our Region and Regional Coordinatorship

- Seniority Plaques were presented to our employees who completed their tenth year in our company

- Webinar themed as Law No. 7326 on Restructuring of Certain Receivables Held

- Plaque Presentation Ceremony to the Winners of the Composition Contest on Letters to Ataturk and to our Selection Board

- Our Plaque Presentation Ceremony to Our Employees Who Have Completed 15, 20, 25 Years in our Company

- We Listened To The Turkish Kidney Foundation In Our Lighting Meetings

- Seniority Certificates were presented to our employees who completed their fifth year in our company

- As ÜNSPED, we held the ninth of our Customer Advisors Board meeting.

- Ordinary Meeting of General Assembly for 2020 Was Held

- Our Current System Applications Training Was Held

- Webinar Themed as International Commercial Integrations Was Held

- 19 May Festival in Ünsped

- Winners of Composition Contest on Letters to Ataturk Were Announced

- We participated in the session titled

- Certificate of Appreciation from Social Insurance Institution (SII) to ÜNSPED

- We Celebrated the Eid Al-Fitr of Our Employees

- ‘Our Webinar On “Petition Follow-Up Program & Transportation Insurance” took place

- Happy Mother's Day for All Our Women Whose Hearts Are Full of Feelings of Motherhood

- 23rd April Painting Competition Special Jury Prize

- Our webinar on “Reading invoices and discounting” took place

- Nur Ger Was the Guest of Our Enlightenment Meetings

- Our Webinar Themed "Tariff Expertise Training" Was Held

- Our Webinar Themed "Türkiye–United Kingdom Current Protocol of Origin" Was Held

- Our Webinar on ''Administrative Sanctions (Penalties) at Customs) Legal Remedies (Objection-Conciliation)'' was Held

- UGM 23rd April Painting Competition qualification

- The Guest Of Our Enlightenment Meeting Was Banu Noyan.

- The Guest of Our Enlightenment Meetings was Doctor Levent Bayraktar

- Our Customer Work Portal Training Took Place

- Guest of Our Enlightenment Meetings Prof. Dr. Fatma Ayanoğlu

- Information Training Within the Scope of Personal Data Protection Law

- We received first aid update and electroshock device use (OED) training

- Guest of Our Enlightenment Meeting was Prof. Dr. Sadi Uzunoğlu

- We Celebrated World Happiness Day on 20th March

- We were at the X. traditional logistics and trade meeting

- Our First Management Team Meeting Took Place for 2021

- Our evet on

- Our webinar on “Outward processing regime and applications” took place

- ''Everything you see on earth is the work of women ''

- ''If there is communication; there are no obstacles

- Our Committees were in Bakırköy Closed Women’s Prison on International Women’s Day

- Our Webinar Themed "Transit Conventions and Transit Regime" Was Held

- Support for Women Entrepreneurs; Nar Women's Cooperative Products, In Ünsped Cafeteria with Their Local Tastes

- Prof. Dr. Turgay BİÇER was our guest as part of our enlightenment meetings

- Our Webinar on "Investment Incentive Regulations and Regional Supports" was Held

- As Part of Enlightenment Meetings, Mr. Kemal ÖMERCİ was our guest

- Former Prime Minister Binali Yıldırım Met With Industrialists

- As Part of our Enlightenment Meetings, Ms. Beril KOPARAL was our guest

- Our Webinar Themed "Internal Processing Regime Applications II" Was Held

- ''The Only Thing That Increased When We Share Is Love''

- Our national catering company team and UGM managers met at Tea Time

- Our Webinar Themed "Internal Processing Regime Applications" Was Held

- ÜNSPED Social Responsibility Committee Project -

- ''Cancer Is Overcome By a Society That Is Not Intimidated, But Conscious''

- Ms. Selda KARA was our guest as part of enlightenment meetings

- R & D Awards were delivered

- Our webinar on “TAREKS applications, TSE and TDSHM audit processes and applications to be considered” took place

- The R & D Awards of 2020 are delivered.

- Safety Culture and Awareness was Created with Emergency and Evacuation Drill

- Our webinar on Delivery and Payment Methods took place

- “Future of Turkey-UK trade relations after FTA”

- Our webinar on “Foreign Trade Regulations that we have taken over from 2020 to this year” took place

- We can do for you

- Within the scope of Lighting Meetings, Mr. Ersan ACIKAY Was Our Guest

- We Continue To Present the Awards of the Year 2020

- We constantly search for conscious and dynamic service

- Fast and reliable delivery

- Webinar on “Customs Tariff and tariff interpretation rules” took place

- Customized Service

- Ass. Dr. Sinan Erdoğan was our guest within the scope of our enlightenment meetings

- Customer Satisfaction Focused Work Is Our Priority Goal

- The winners of the 2020 Performance and Special Awards announced

- In cooperation with AHK & UGM, webinar titled

- Our Webinar on Basic Customs Legislation Amendments in 2021 Took Place

- Webinar titled 2021 basic Customs and foreign trade legislation amendments took place under the Coordination of UGA

- Our Management Approach Is Participatory

- Within the Scope of Business and Trade School (Executive School) Program

- Plaque of gratitude from Turkish National Olympic Committee (TMOK) to Ünsped

- We're together in our 40th anniversary

- As Part of the Enlightenment Meetings, Our Chemist, Dr. Ayşe Özgür ÖZSAR was our guest

- We provide safe and healthy working environment for our employees

- Bilgi University Faculty of Communication Instructor Asst. Prof. Dr. Dear Itır Erhart Beyazyürek Had a Seminar in Our Company with the Collaboration of UGA and Women Leadership Development Committee

- We Provide a Safe and Healthy Working Environment for Our Employees

- The first training of the year took place with the subject of “Customs Union and Origin.”

- With our understanding of internal criticism, we aim to continuously innovate and develop

- Our Employees Are Our Most Valuable Resource

- We celebrated the achievements and New Year of Our Girls Playing in our volleyball “A” team in the TVF Women’s 2nd league

- All Our Business Functions Act As a Whole

- İpek KIZILCIKLI, Corporate Communication Specialist of PORLAND Company, was our guest within the scope of enlightenment meetings

- Our Webinar on "Export Development" was Held in the Coordination of UGA

- All our departments proceed in line with their given target

- We keep up with innovations through our technological infrastructure

- We reviewed our 2020 business processes with self-assessment

- Marmara University Lecturer Assoc. Dr. Arzu BALOĞLU was our guest as part of our enlightenment meetings

- Academician, Economist & Author Prof. Dr. Emre Alkin Was Our Guest As part of our enlightenment meetings

- Our webinar on the value of goods and import duties took place under the Coordination of UGA

- Sinem IRMAK, Corporate Communications Director of Zen Diamond Was Our Guest within the scope of enlightenment meetings

- Our Company Partner talked about foreign trade and customs clearance in

- Our webinar on “customs processes of goods to be shipped to Turkey” took place under the Coordination of UGA

- In Cooperation with EİB & UGM

- As part of the enlightenment meetings, Bisse Company Deputy Chairman of Board, businesswoman Asiye KEFELİ was our guest.

- In Cooperation with the German - Turkish Chamber of Commerce and Industry & UGM

- Our Webinar on

- Our Vocational Development Training on Inward Processing Permit Legislation and Practices Has Been Held

- We have never stopped learning from each other by using the opportunities of digitalization.

- Children are the guarantee of the future

- Our business partner Özyaşar Tel ve Galvanizleme San. A.Ş. received the

- Dr. Nurdan TEKEOĞLU and Gaye BİNARK were guests of Our Women's Leadership Development Committee,

- Webinar on

- The guest of our Employee Communication and Workplace Happiness Committee was Uygar YABAR

- We remember our Ata with respect and gratitude

- We Congratulate Our Supplier's Success

- Selcen Faydasıçok Was the Guest of Our Women's Leadership Development Committee

- Management Served Food to Its Employees in the 40th Anniversary of UGM

- We are entitled to obtain “COVID-19 Safe Service Certificate”

- Our business partner Sun Express received

- Semra İnce Was the Guest of Our Women's Leadership Development Committee

- Our organization themed "Sweet Communication" was held

- Fatma AYDOĞDU and Filiz Akkaş were guests of our Ünsped women's Leadership Development Committee

- We completed the stress and concentration seminar in our headquarters and regions

- We welcome our fall semester interns

- Ayla ERDİM and Semra Saniye MERT were the guests of our enlightenment meetings.

- Ülkü Diri was the guest of our enlightenment meetings

- Our seminars has continued with the cooperation of Chamber of Industry of Kocaeli

- First aid update and OED (AUTOMATIC EXTERNAL SHOCK DEVICE) use training took place

- Our webinar on All Aspects of Origin Seminar with Questions and Answers

- Our personal development training on stress and concentration met with our employees

- The Guest of Our Women's Leadership Development Committee Was Ms. Aysun Sökmen, Owner of Gündönümü Company Farm

- Our Covid 19 measures continue

- Our Covid 19 measures continue

- Our Covid 19 measures continue

- Our Covid 19 measures continue

- The Guest of Our Women Leadership Development Committee was the Founder of Petektar Tohum, Agricultural Engineer Mr. Büşra YAPICI

- In the concept of enlightenment meetings hosted by the UGM Women's Leadership Development Committee we discussed the topic of

- Let not to spoil our enjoyment. Under the leadership of Unsped Employee Communication and Workplace Happiness Committee, our headquarters and Erenköy branch of Anatolian side Regional Directorate welcomed Eid al-Adha with chocolate waterfall.

- As part of the enlightenment meetings, we held the webinar

- On 16.07.2020, our webinar on

- We organized webinar with German-Turkish Chamber of Commerce.

- Our Stress Management Awareness Seminar took place.

- We perform current legislation enlightenment in digital environment

- We held our extended executive board meeting in digital environment

- We held a webinar with the Swedish Chamber of Commerce.

- We attended the webinar organized by the Istanbul Bar Association

- We are at your service with our 3000 square meter free warehouse in Istanbul Airport for your export transactions

- We create a healthy and safe environment for our employees.

- Precautions were Taken in All of our Offices and Branches within the Scope of the Measures Taken to be Protected From Coronavirus.

- We Have Taken Our Measures As ÜNSPED Customs Brokerage Against Corona Virus.

- Information Transfer About Corona

- We Performed Our Meeting on “Social Consciousness”

- We Held The Exhibition titled

- We presented seniority plaques and certificates to our employees

- March 8 International Women's Day

- Within the Scope of Professional Development Trainings, We Discussed the Subject of "Recent Changes in the Authorized Obligation System"

- Our Employee Communication and Workplace Happiness Committee Came Together with Our Hearing Decelerated Employees with the Theme of

- Our Seminar on Last Changes in YYS to be held on March 04, 2020 Has Been Held

- We were at

- Our lawyer Gülsen TOPÇUOĞLU gave information on “What should we do when we witness or are exposed to violence?”

- Keeping Internal Communication Channels Open Is Our Biggest Goal

- Our awareness meeting on ‘It is a Right to Exist’ was held under the leadership of ÜNSPED Social Responsibility Committee

- Haluk ÜNDEĞER Primary School students awarded for their achievements in traditional games

- The First of Our Professional Development Training for the Spring Term of 2020

- First of Our Culture and Taste Tour

- All People are Different When They Love We Celebrated Valentine's Day as ÜNSPED Employee Communication and Workplace Happiness Committee

- Polifarma İlaç Sanayi ve Ticaret A.Ş. Company Owner Visited Our Company

- Under the leadership of our Women's Leadership Development Committee, we touched on the issue of women's health and smoking

- Our Effective Communication Trainings Continue

- Our Enlightenment Meeting on "Health Communication: Be Aware of Cancer, Don't Let the Colors in Your Life Fade" was Held

- Our Extended Executive Board Meeting Took Place

- Our "Blood and Stem Cell Donation" Themed Briefing Seminar Took Place

- Our ERP Meeting and Petition Tracking Program Training Took Place

- Effective Communication Training

- Library From Orange Crates

- The Autograph Session of the Novel “Kurt Klanı” (The Wolf Clan) is Made

- Our 2020 Customs and Foreign Trade Legislation Information Seminar Has Been Held

- Authorized Economic Operator Certificate is Handed Over to Nemak İzmir Döküm Sanayi A.Ş.

- We Carried out Our Foreign Trade Career Meeting Program with Halkalı Vocational and Technical Anatolian High School

- Customs Brokerage Minimum Price Tariff Training Took Place on 09-10 January 2020

- We Talked about the Topic of

- Our Customs Legislation Amendments Training Took Place on 7 and 8 January 2020

- Each New Period Starts with New Opportunities, New Hopes, New Plans: We Celebrated the New Year with All of Our Employees

- We were at the Service Exporters Meeting and 2018 HIB Award Ceremony

- We held our 38th Traditional Year-End Assessment Meeting with the Theme of

- ÜNSPED Anatolian Meetings: We are in İzmir

- Our Anatolian meetings has been continuing: We are in Mersin

- Our Seminar on "Women in Environment and Sustainability" was Held

- ''Emergency Evacuation Drill'' was performed in our Aegean Regional Directorate

- President of the Association of Defense Industry Manufacturers Visited Our Company

- We attended the Buyernetwok

- Our Professional Development Training Continues

- Occupational Health and Safety Training Continues

- The president of the Turkish Plastics Industry Research and Development and Education Foundation (PAGEV) visited our company

- Our Company was Awarded 2019 Transparency Awards

- We performed 2nd of our business development meetings with conference participation from regions

- We performed Incoterms 2020 Information Seminar in Aegean Exporters Union

- Ms. Mine EKİNCİ, founder of KODA, Village Schools Association, was the guest of our women's Leadership Development Committee

- We attended TÜSİAD High Consultation Board Cocktail

- Our First Business Development Meeting Took Place

- We Hosted Bekir Sütcü, Chairman of the Board of Directors of Adana Hacı Sabancı Organized Industrial Zone, in the BloombergHT Program

- Business Cup 2019 Fall Season The Most Gentlemen Team Award

- We celebrated Teacher's Day in ÜNSPED

- We continue to realize our Unsped Anadolu Foreign Trade Meetings.

- We talked about 2020 with our industrialists in Adana.

- Dilovası Machinery Specialized Organized Industrial Zone Association of Machinery Manufacturers (MIB) and our company in cooperation with our training took place

- Seminar on Legislation of Origin, Additional Customs Duty and Additional Financial Liability Applications

- Our Earthquake, Emergency and Evacuation Drills

- Gaziantep Economy Investment and Foreign Trade Meeting

- As ÜNSPED, we held the eighth meeting of our Customer Advisory Board.

- We Met With The Workers on the Vehicle and Courier Department

- Our seminar on “Draft Law Proposal on Amendments to the Origin Legislation and Customs Law” was held

- We Celebrated the 96th Anniversary of our Republic

- On 26.10.2019 Ünsped customs brokerage board and committee directors were convened under the chairmanship of our company partner Yusuf Bulut Öztürk.

- Our seminar on examination of current legislation amendments and issues in 2020 perspective was held

- Our 2019 UGM partners meeting took place

- 11th Traditional Year-End Meeting is held

- We Took Our Place at the 6th World Automotive Conference

- Our Company Took Part in UGM Fair Play Universities Caravan Project

- On-Going Seminars in Collaboration with Kocaeli Camber of Industry

- We took our place at the conference on industrial growth in the National Defense and aerospace industry held with international cooperation on October 10-11, 2019

- We Visited Eskisehir Chamber of Industry

- Our Professional Development Trainings Were Held on 03-04 October 2019

- On-Going Business Development Meeting with the Customers… This time, we meet at our Head Office.

- 12th Management Team Meeting was held on 28.09.2019

- Our Professional Development Training Took Place on 03-04 October 2019

- Our Blockchain Meeting Took Place

- Our disclosure meeting on “Fair Play in business and sport” took place

- We listened to

- UGM Awarded the International Fair Play Committee's Fair Play of the Year Award 2018

- We Made Our Courtesy Visits

- We Were on Lunch with Our Newly Recruited Personnel

- We gave Training on

- Ciner Holding Interns Took Their Vocational Development Trainings in our Company

- Our South Korea FTA and Suspension System Training was Held

- Students who will undergo internship in our company and our Company Partner Yusuf Bulut ÖZTÜRK came together

- Ankara Chamber of Industry President Visited our Company

- We Unveiled our UGL Temporary Storage Yard and UGM Customs Office

- Our Employees were in Canoe Activity under the Leadership of Young Generation Leadership Development Committee

- Our Fathers are Our Supports

- We listened to issue of "Being a woman in the communication sector" from author-career consultant-Mastercamp training platform founder Ms. Zühal GÜRÇİMEN

- We are at the 8.International Logitrans Transport Logistics Fair

- “Each book is a window opened to the world”

- We listened to the issue of “Being a woman in the energy sector

- Our Young Generation Leadership Development Committee celebrated 19th May with the theme of

- We Listened the Topic of "Being Women in Movie Cinema Industry" from the Owner of Kadıköy Cinema Ms. Funda KOCADAĞ

- We Congratulate Our Employee Ms. Şeyda CANBOLAT for her Success in Hearing Impaired Turkish Championship

- The second seminar of customs legislation and practices has been performed

- Mothers Grow the Seeds

- We Listened the

- Our "Origin" Themed Training Took Place on 04 May 2019

- Ünsped Employee Communication and Workplace Happiness Committee Commences Ramadan Preparations

- All our employees makes us become stronger with their works

- Training on Negotiation and Conflict Skills has been realized

- We were at Istanbul Fair of Career and Employment on 24-25 April 2019

- Trainings on TTS (Demand Tracking System) and IVI (Return and Dispute) System were given to our employees on 24-25 April 2019

- ÜNSPED Social Responsibility Committee Becomes a Partner in the Enthusiasm of Children

- Employee Communication and Workplace Happiness Committee Organized a Hello to Summer Trip in Edirne

- ÜNSPED Social Responsibility Committee Supported My Village Project

- We have given the Seniority Certificates and Certificates to our Kocaeli Region Employees

- Training on problem solving and time management, emphasis on priority tasks has ben realized

- We hosted Mr. Cüneyt SEZGİN, Board Member of Garanti Bank A.Ş. within the scope of Lighting Meetings

- Our shareholder Yusuf Bulut Öztürk has met with Aegean Regional Customer Representative

- Training on Standard Management System

- Young Generation Leadership Development Committee was at the Eser Yenenler Show

- Our Training Cooperation with the Kocaeli Chamber of Industry

- Our Seminar on the Place and Importance of Teamwork in Communication has been realized

- Our employees are the essence of our company

- Sharing Management, We Act as a Whole

- We were at 'Logistics Talks' at İstanbul Gelişim University

- We were in the organization of women in Social Entrepreneurship and Management

- We Celebrated 20 March World Happiness Day with

- We Visited Arpaçsakarlar Elementary School within the Scope of

- Our Most Valuable Source is; Our Employees

- We were in Aegean Regional Directorate with our

- We were in Chamber of Industry on 07 March 2019

- We Commemorated March 8 International Women's Day with

- 2018 Seniority Plaques and Certificates are Presented to Their Holders in our Headquarters

- We made our Second Visit to Kurtköy Forest with Our Social Responsibility Committee

- Our Enlightenment Meeting on 'Empathy for Barrier-Free Success' was Held

- 2018 Çukurova Seniority Plaque and Certificate Presentation Took Place

- Plastic Cap Campaign Project - ÜNSPED Social Responsibility Committee

- We were in XII. Corporate Management Summit: Change Balance Value Summit

- Customs Clearance Before Arrival Themed Seminar Took Place

- Our Exhibition Themed "OBJECTIVE COMMUNICATION" Has Been Opened

- Brand Course Project has Started

- We Made Our First Visit to Kurtköy Forest with Our Social Responsibility Committee

- Our Seminar Themed "2019 Import Regime Decisions and Changing Foreign Trade Practices" was Held

- Our First Customs Legislation Training was Performed

- Let's Write a New Success Story in 2019; Many Beautiful and Happy years Together

- Our seminar titled “Customs Legislation and Practices” has been held with the collaboration of the UGM and Kocaeli Chamber of Industry.

- Our Shareholder Mr. Yusuf Bulut ÖZTÜRK came together with our Young Generation Employees who consist of Valedictorians

- Business Summit within the Scope of Customs and Foreing Trade Specialty Certificate Program in ÜNSPED

- Our 37th Traditional End of Year Evaluation Meeting Took Place with

- Inward Processing Regime themed Workshop Took Place

- The Board of the Ünsped Woman’s Entrepreneurship Association visited the Necmi Hoşver Primary School in Düzce at the 27th September

- Our "Management and Leadership" themed Trainings Took Place

- Our "Communication and Emotional Intelligence" themed Training Took Place

- Teachers' Day in ÜNSPED

- Our Youth Summit Themed

- We as Ünsped Gümrük Müşavirliği ve Lojistik Hizmetleri A.Ş. were in the Export Academy Training Program

- Customs Implementations for New Period Additional Financial Liability and Additional Customs Duty Seminar

- Our training was performed in cooperation with TAYSAD - Association of Automotive Parts and Components Manufacturers and Unsped Development Academy (UGA)

- UGM Shareholders Meeting

- UGM Emergency and Evacuation Drill

- Our First Aid Training Took Place

- We were in Ankara Logistics Summit

- Our Seminar on "Documents and Terms Used in Foreign Trade" was Held

- The Opening of the Painting Exhibition with the Theme of Happiness

- We share management, act as a whole

- We were in Istanbul Airshow

- Our Seminar themed

- Our Training themed "Origin, Preferential-Non-Preferential Origin, Customs Union, Free Trade Agreements, Cumulation of Origin" was pereformed

- The visit of the Semiha Şakir Nursinghome by the Ünsped the Woman’s Entrepreneur Association