Ömer Haluk TURANLI

UGM EDUCATION CONSULTANT

As technology developed with geometric increases and the increasing trade volume required "simpler, practical, faster and lower-cost solutions," many trade-related instruments and operations began to "evolve into digital versions." In our age, digitality has become a necessity rather than "a choice or an alternative." So, did letter of credit transactions benefit from this process?

Let's say a lot about letters of credit. Yes, technically, it is the safest payment method, but when it comes to implementation, it starts to falter. No other form of payment will divide the relevant social circle so sharply.

TOO TECHNICAL FOR THE AVERAGE TRADER…

Likewise, it is a fact that the payment method has the most protection for both the importer and the exporter among the existing payment methods. However, it needs to be more technical for the average trader; its legislation and bureaucracy are too voluminous and far from objective. It is possible to say that it is a payment method that "does not allow customers to develop arguments against the bank they work with, "leaves the customer to the initiative of the bank since the bank is the stronger party providing the loan," and is "relatively expensive."

NOT USER FRIENDLY…

It is not a "user-friendly" method. It requires a certain degree of specialization. Imagine You know the publication number 600 (Uniform Procedures and Code of Practice for Letters of Credit - UCP 600) of the International Chamber of Commerce (ICC), and you will also know the publication number 781 published by the same institution (International Standard Banking Practices-ISBP 781); This will not be enough, you will also need to examine the disputes concluded by DOCDEX (Documentary Instruments Dispute Resolution Expertise), which is a dispute resolution procedure of the ICC. When you encounter a problematic event, commenting on the existing rules does not save you, and you will need to know jurisprudence.

GLOBAL USE RATE IS 15 PERCENT

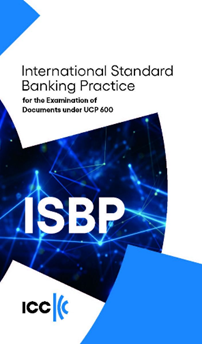

Both global trade and Turkey's foreign trade statistics prove me right. Likewise, although the usage rate varies from country to country, the type of product traded and some other criteria, the global average usage is only around 15 percent. When we look at Turkey's foreign trade, the situation is even worse. While the letter of credit usage rate in imports is 6.01 percent in the first 10 months of 2023, this rate decreases to 3.70 percent in exports*.

THE METHOD OF PAYMENT AGAINST GOODS IS IN DEMAND…

What is even more striking when looking at the table is that the form of payment against goods is by far the leader with 69.01 percent, "despite it being the riskiest payment method in exports". On the other hand, when we look at imports, the same situation occurs there as well. This means that there is high trust in Turkish merchants.

DIGITALITY IS NOW AN OBLIGATION…

As technology developed with geometric increases and the increasing trade volume required "simpler, practical, faster and lower-cost solutions", many trade-related instruments and operations began to "evolve into digital versions". In our age, digitality has become a necessity rather than "a choice or an alternative". So, did letter of credit transactions benefit from this process?

In fact, letters of credit have already been partially digital for a very long time. For a letter of credit to be opened, there must be a SWIFT (Society for Worldwide Interbank Financial Telecommunications) connection between the relevant banks and financial institutions.

Not only letters of credit but almost all transactions between banks (sending-receiving money, transactions against documents, sending-receiving instructions, etc.) are carried out through the SWIFT system, an electronic network. By the way, letters of credit can rarely be opened by letter, especially in underdeveloped countries. From this perspective, the letter of credit process starts in a digital environment.

THE INVISIBLE PART OF THE ICEberg…

But this is, unfortunately, the tip of the iceberg. As you know, what sinks the ship is the invisible part under the water. We can summarize this invisible part in these four. The exporter prepares his documents physically. The prepared documents are physically presented to the exporter's bank, which physically transmits these documents to the importer's bank. (This factor makes the process longer and the cost higher.)-The importer's bank carries out these checks physically. (These checks, carried out by expert bank employees, are precisely where the "bullshit goes.”) The important thing is that these four phases can be created digitally. Will it be possible to discuss a fully electronic letter of credit?

IT IS NOT DIFFERENT FROM A TRADITIONAL LETTER OF CREDIT…

The application known as an electronic letter of credit is the use of new generation commercial documents (which are called electronic records), which enable these four stages to be disabled, are issued electronically, their authenticity and validity can be confirmed electronically, and can be transmitted digitally both from the exporter to the bank and between banks. Is possible. In other words, the electronic letter of credit is not different from the letter of credit we know as the traditional letter of credit. It is a digitalized process using electronic records and their electronic submission within the scope of conventional letters of credit. For example, MSC company's eBL application is an excellent example of these documents. Digital origin and circulation documents, which can be approved by the issuer with an electronic signature and transferred and confirmed digitally via the Internet infrastructure, are also good examples.

THE MAIN PURPOSE OF eUCP…

As the mentioned digital records increase and become more integrated into commercial life day by day and the use of electronic letters of credit begins to grow, ICC has established eUCP (ICC Uniform Customs and Practice For) to regulate electronic letters of credit, albeit as an annex to the UCP mentioned above 600. Documentary Credits for Electronic Presentation). eUCP, first published in 2002, is a supplement to UCP600, as stated above, and is not an independent publication. There is no such thing as an electronic letter of credit. Since the practice is the electronic presentation of electronic records in the presence of a letter of credit, the primary purpose of eUCP, as the name suggests, is to regulate only the electronic presentation of electronic records or the presentation of electronic records together with printed documents in the presence of a letter of credit.

BANK PAYMENT OBLIGATION (PAY)…

While closing, I would like to greet BÖY (Bank Payment Obligations), which, I believe, is a genuinely electronic payment system. Even though they insist that BÖY is not a letter of credit version but a different payment method, If there is to be an instrument called an electronic letter of credit, I think it should be BÖY, which "functions like a letter of credit and proceeds in a fundamentally simple way such as transferring data, not documents, to the system, and the control and matching processes are completed digitally, completely without human intervention."

Back

Back