Tariffs on Critical Minerals and their Role in the Electric Vehicle Value Chain

The transition towards clean energy technologies and electric vehicles (EVs) is gaining momentum as the world tries to tackle climate change. However, this transition requires greater use of critical minerals such as cobalt, graphite, and lithium, key components of EV batteries. Hence, the use of increased tariffs in EV production chains could prevent emerging economies from diversifying their exports and moving up the value chain.

Clean energy technologies rely heavily on various minerals. For example, solar energy relies heavily on copper, aluminum, cadmium, tellurium, tellurium, and selenium, while wind energy requires copper, rare earth, chromium, zinc, and aluminum. In the production of electric vehicles and their batteries, aluminum, copper, cobalt, graphite, nickel, lithium, manganese, and rare earth elements are used.

As a result of the global transition towards clean energy technologies and EVs, the demand for certain critical minerals such as cobalt, graphite, and lithium (minerals abundant in emerging economies) is expected to increase significantly. Forecasts indicate that demand for these minerals will increase five-fold by 2050 due to the intensive use of new energy technologies.

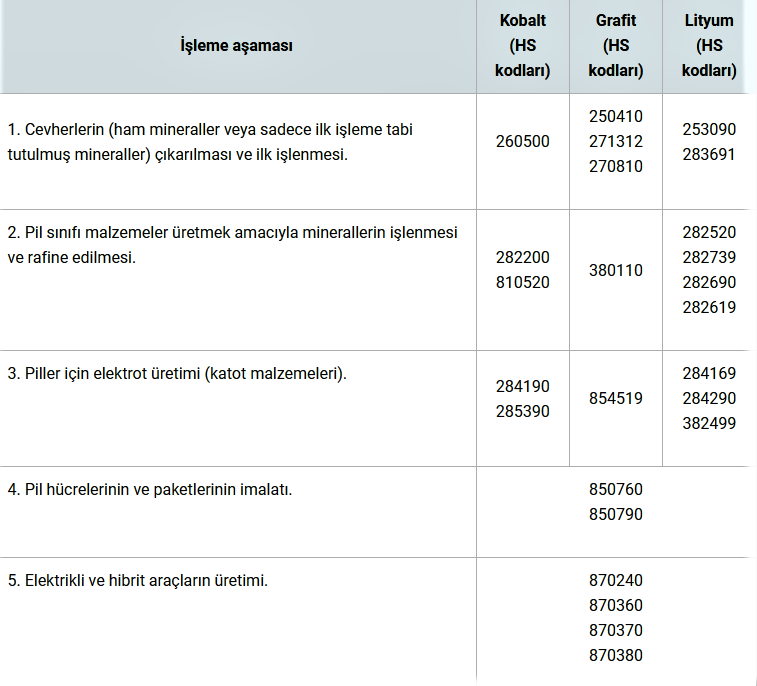

Stages for Critical Minerals in the Electric Vehicle Value Chain

The EV value chain for cobalt, graphite, and lithium consists of five stages: extraction of raw minerals, processing of minerals, production of electrodes for batteries, manufacturing of batteries, and production of EVs (see Table 1). Trade flows for critical minerals occur at each stage of this value chain.

Table 1: Stages and corresponding Harmonized System (HS) codes for critical minerals in the EV value chain

Tariffs and Tariff Increase

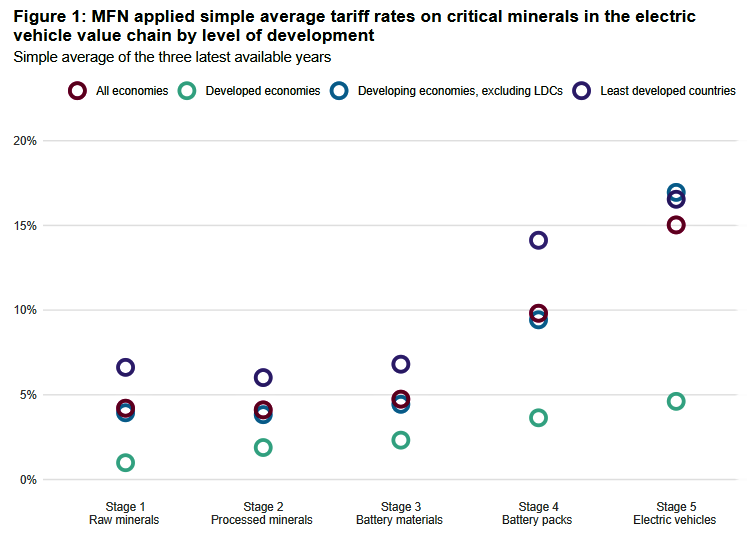

Tariffs on products related to the EV value chain can vary at different processing stages and across economies. In general, tariffs on battery packs and EVs are significantly higher than tariffs on raw minerals and battery minerals, and there is a clear pattern of tariff escalation moving up the value chain. Against this backdrop, Figure 1 summarizes the tariffs applied to critical minerals along the EE value chain by economies at different levels of development.

Developed economies tend to have lower tariffs at all stages of the EV value chain. However, tariffs increase along the supply chain, with the highest tariffs applied to processed and finished goods. This potentially hinders the ability of developing economies to move up the value chain.

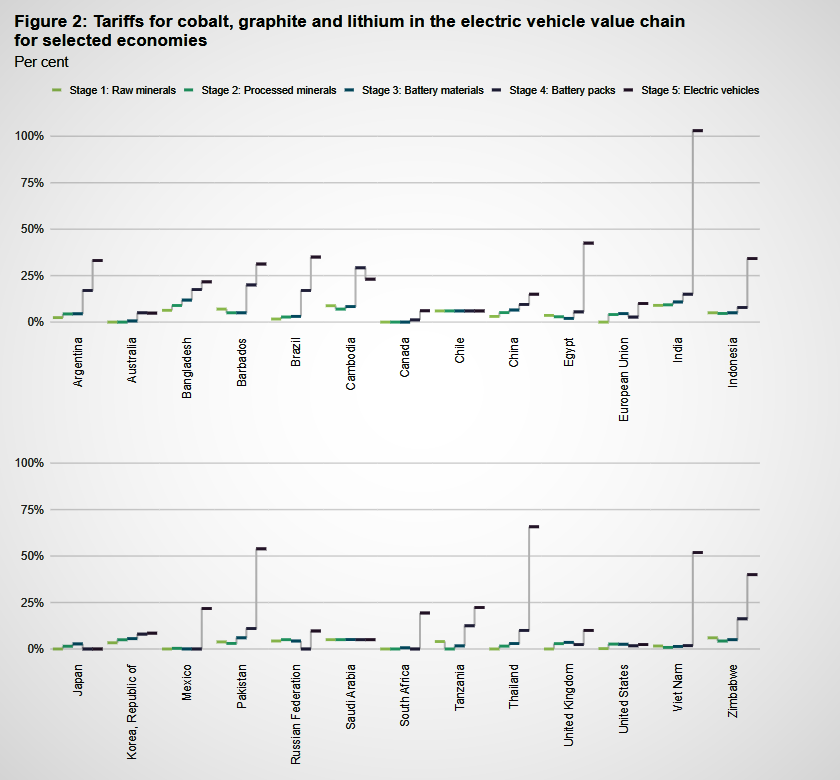

More than three-quarters of economies surveyed exhibit increasing tariffs between the first and fifth processing stages, although the extent varies widely. But in almost all cases, the highest tariffs are applied at stage 5 (see Figure 2).

The table shows that tariff increases have been most pronounced in the agriculture and textile sectors. Figure 2 underlines that this poses a similar challenge for economies trading in critical minerals. Flattening tariffs alone may not be enough to influence choices about the location of high-value processing activities, but it is an important step to support the transition to clean energy and ensure sustainable development.

In addition, to capitalize on the demand for critical minerals, emerging economies need to attract investment for refining and processing facilities. They also need increased technology transfers to develop local capacities to participate in higher-value stages of the EE supply chain. They therefore need to ensure the equitable distribution of benefits from trade in mineral resources by strengthening governance and adopting sustainable practices, balancing economic gains with environmental and social considerations.

Conclusion

Emerging economies with rich mineral resources can benefit from increased demand for cobalt, graphite, and lithium, but a well-functioning multilateral trading system, supported by a fair tariff system at a lower level, is essential to enable these economies to participate fully in the global EV value chain. Addressing tariff escalation in the critical minerals sector and promoting sustainable development practices can lead to structural transformation in developing economies, creating a more level playing field and improving living standards in these economies.

Back

Back