The IMF's Sovereign Debt Restructuring Process Thrives in an Environment of Cooperation and Reform, underscoring the collective responsibility and involvement of all stakeholders.

The global economy has avoided what could have been a systemic debt crisis during the turbulent period of recent years. Still, vulnerabilities remain due to high debt servicing costs, which pose a significant challenge for low- and middle-income countries. This is because some economies have yet to face substantial tests.

When countries stumble on debt, restructuring is critical to limit the damage. Therefore, restructuring should be done as soon as possible because delays will make compliance difficult and increase costs for both debtors and creditors, deepening the distress.

While some sovereigns are experiencing significant restructuring delays, the IMF is working with its stakeholders to accelerate the process. The progress so far demonstrates how the world can work together to reduce risks.

Common Framework Started to be Presented

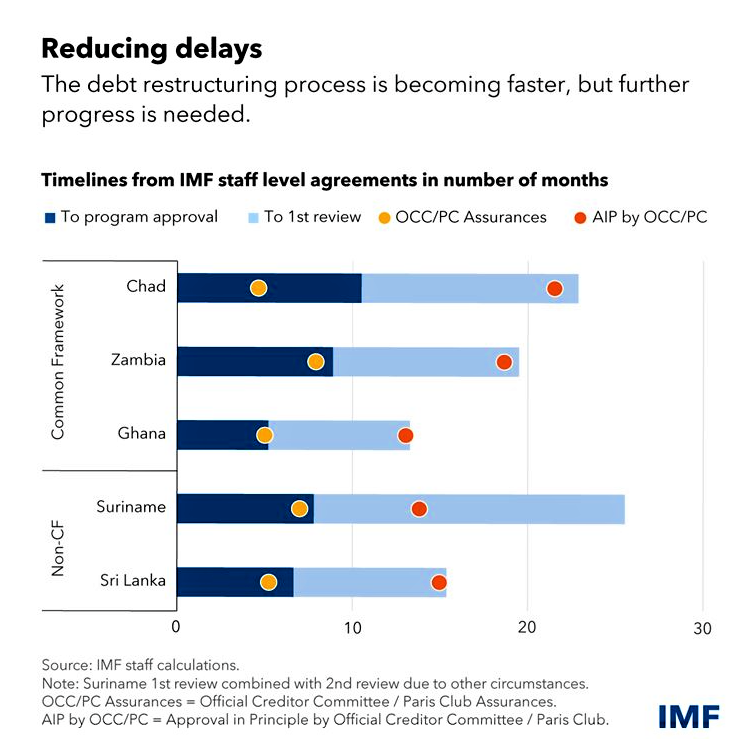

The 'Common Framework,' which brings together creditor countries to help restructure debts when needed, has started to materialize. But how? The IMF will seek to restructure the debt, shortening the time from the IMF staff-level agreement- a critical step for its program- to the formal creditor and financing assurances needed for program approval. This means the fund can move more quickly to provide much-needed financial assistance to the country. For example, Ghana's deal this year took five months to complete these steps, about half the time it took the Republic of Chad in 2021 and Zambia in 2022. On the other hand, negotiations in Ethiopia are estimated to continue for closer to two or three months, possibly faster.

These improvements have been made possible in part because stakeholders have gained more experience working with non-traditional official creditors such as China, India, and Saudi Arabia. Earlier cases presented creditor coordination challenges. However, greater familiarity with the process has helped parties know better what to expect, built trust, and helped creditors more easily overcome situations that had previously stumbled.

We are also seeing an acceleration of the debt restructuring process for emerging market countries outside the 'Common Framework.' Sri Lanka's case, for example, was faster than that of Suriname, which preceded it in 2021, and had a better approach to creditor coordination improvements, safeguards, and collateral.

IMF to Reorganize Debt Policies

The IMF is dedicated to restructuring countries' debts to speed up the process further. This is why the board of governors introduced important reforms to its debt policies in April. These reforms are in line with our mission to;

- provide tools to allow for the approval of an IMF program generally within two or three months of a staff-level agreement, including measures to help us move forward where there are coordination problems among creditors. Then, as soon as financing assurances are in place, approval in principle of programs that allow for disbursements will increase transparency and help complex cases to proceed according to such a schedule.

- A new procedure for establishing financing guarantees will be established, which will provide more flexibility over time. Accordingly, the Fund will assess that a "credible formal creditor process" is underway based on creditor actions and creditor delivery performance. This will eventually be much faster than the current practice of waiting for official letters.

As delays can intensify the crisis, the IMF is committed to facilitating faster interaction with the debtor country through these reforms. Moreover, these reforms will also provide creditors with more information to help them reach restructuring decisions faster, reinforcing the IMF's commitment to transparency and efficiency.

Alleviating Liquidity Constraints

In an environment of enormous long-term financing needs for economic development and to tackle climate change, more will be needed to tackle debt problems and avoid the distress caused by high interest rates and financing needs. Borrowing countries, creditors and the international community therefore have a role to play. Borrowers must be able to create space to finance development and climate-related spending, stimulate economic growth and increase government revenues, while keeping debt on a sustainable path. And given that policy reforms in borrowing countries will take time to bear fruit, official lenders should consider mobilizing more financing at lower cost, particularly grants. The Fund will continue to support these efforts and provide adequate financing, including through a review of concessional facilities.

Back

Back