Structural transformations in Global Value Chains (GVCs) reveal how external shocks such as the COVID-19 pandemic and rising geopolitical tensions increasingly influence investment decisions and hinder development.

Here are some key findings.

FDI is struggling to keep pace with trade and GDP

Since 2010, global GDP and trade have grown at an average annual rate of 4 percent and 4.2 percent, respectively, despite rising trade tensions. In contrast, Foreign Direct Investment (FDI) growth stagnated near zero.

This stagnation in FDI growth is not just a statistic, but a reflection of significant shifts in international production and GVCs, and increased investor caution due to rising protectionism and geopolitical tensions. It underscores the vulnerability of FDI-dependent emerging economies, a concern that should not be taken lightly.

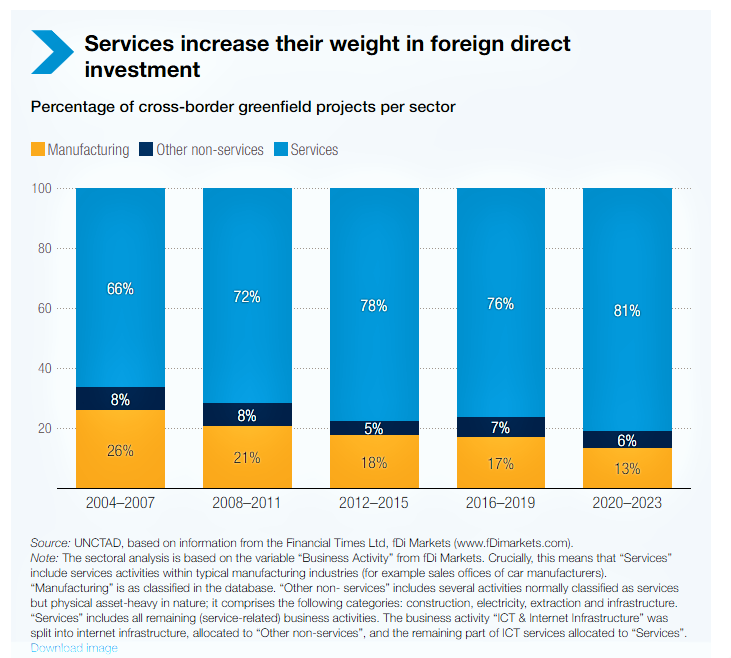

Transition from Production to Services

- The share of cross-border greenfield projects in the services sector has increased from around 65 percent two decades ago to over 80 percent. On the other hand, services-related investments in manufacturing sectors almost doubled to 70 percent, driven by technological advances.

Meanwhile, FDI in manufacturing has shown a significant decline, with a compound annual growth rate of 12 percent in the three years following the outbreak of the pandemic. This decline severely hamper developing economies' efforts to leverage participation in GVCs for economic development and industrial transformation.

The Declining Role of FDI in China

- China's diminishing role as a recipient country has significantly reshaped the global FDI landscape over the past two decades. This process accelerated after the outbreak of the COVID-19 pandemic.

- In the last three years, the number of greenfield projects in China has hovered around one-third of what it was a decade ago.

- Despite the decline in FDI, China's continued dominance in global production and trade is a testament to its economic resilience. This suggests that the 'global factory' model is not shrinking, but rather evolving from globally integrated production networks to more locally oriented ones, a trend that economists, business professionals, policymakers, and researchers should be aware of.

Geopolitical Tensions Increasingly Affect FDI Flows

- Investment between geopolitically distant countries (countries with different political interests or foreign policies) fell from 23 percent in 2013 to 13 percent in 2022.

- This trend has particularly affected the manufacturing sector as trade tensions escalated in 2019.

Investments in Environmental Technologies on the Rise...

- Investments in environmental technologies such as wind and solar energy have increased. Their share in total greenfield projects in the non-service sectors rose from 1 percent in the early 2000s to 20 percent in 2023. Similarly, FDI in electric vehicle and battery manufacturing has grown by 27 percent annually over the past decade.

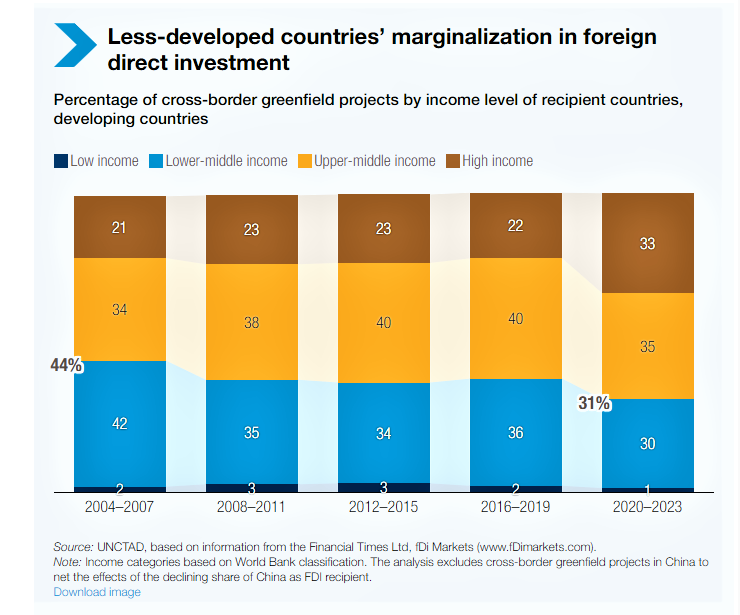

- However, this growth only partially offsets the decline in other manufacturing sectors. Moreover, while this growth has primarily benefited developed countries, least developed countries (LDCs) continue to need help with declining FDI in traditional sectors.

Key Recommendations

Research highlights the urgent need to align strategies with evolving investment trends to ensure that FDI's benefits are fairly distributed and support broad development goals.

For Global Institutions:

- Provide financial and strategic support to developing countries, particularly LDCs, to review their FDI and GVC-based development strategies and enhance their attractiveness to foreign investors.

- Strengthen international cooperation to manage geopolitical risks, reduce tensions, and ensure a stable and open investment climate.

For Governments in Developing Countries:

- Review economic development strategies, as the traditional reliance on manufacturing investment no longer guarantees sustainable growth and economic development.

- Increase linkages with neighboring countries and cooperate at the regional level to strengthen regional value chains.

- Encourage investments in sustainable and green technologies and in other sectors driven by sustainability imperatives and policy considerations.

Back

Back