According to the statement made by the Ministry of Trade, the shopping limits and tax rates of all foreign shopping and e-commerce sites were changed with the decision published in the Official Newspaper.

With this new decision, serious restrictions were imposed on purchases made through all foreign e-commerce sites such as Amazon, Temu, and AliExpress, which are very popular worldwide. Following the announcement by Trade Minister Ömer Bolat, it was seen that with these new decisions published in the Official Newspaper, significant changes were made in commercial transactions made from foreign shopping platforms such as Temu. So, how much is the foreign shopping limit from such sites? Here are the details...

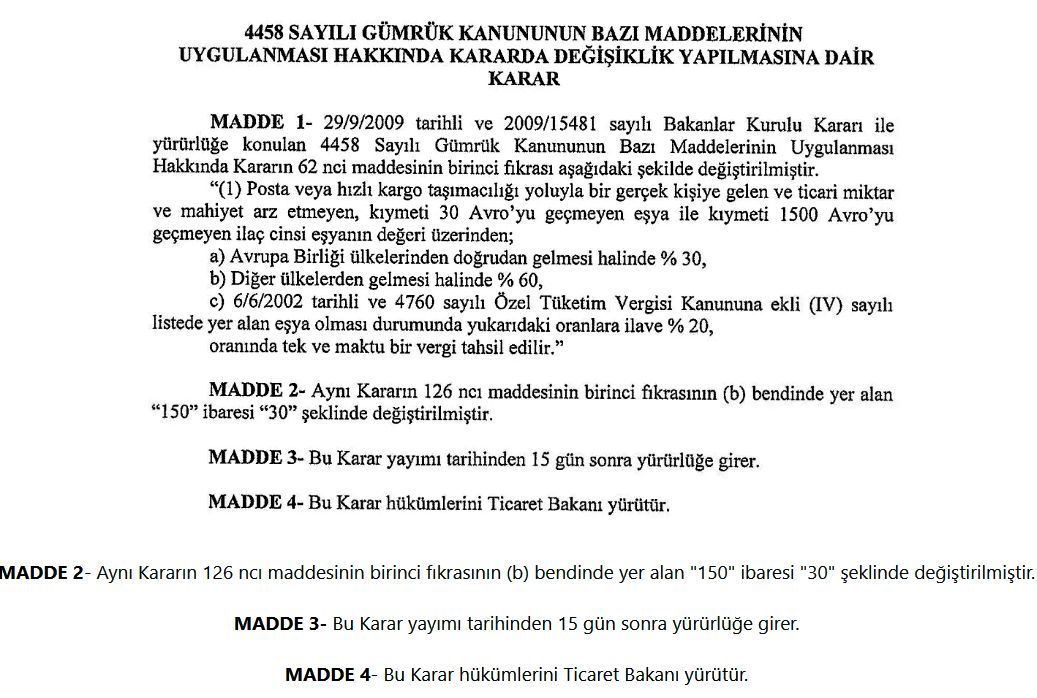

Limit on Overseas Shopping Sites Reduced to 30 Euros

According to the statement published in the Official Newspaper with the Presidential Decree, the fast shipping limit for purchases made abroad was reduced from 150 euros (5800 TL) to 30 euros (1100 TL). After this new limit announcement, citizens' purchases from sites such as Amazon or Temu must now not exceed 30 euros to pass customs. It should also be noted that the current Temu shopping limit is 55 Euros, which is 2000 TL. With this decision, spending limits have been reduced five times.

These new decisions will enter into force 15 days after they are published in the Official Gazette. During this period, citizens can shop at the current limits and tax rates. With these regulations, it is expected that the cost of shopping abroad will increase and shopping will become almost impossible due to low limits.

In summary, according to the decision published in the Official Gazette; As a result of the regulations made in some articles in the Customs Law, the tax brackets were changed between 30 and 60 percent. On Tuesday, August 6, it was announced that the taxes levied on goods with a value not exceeding 30 euros and on pharmaceutical goods with a value not exceeding 1,500 euros will be adjusted between 30 and 60 percent. In this framework;

- 30 percent if coming directly from European Union countries

- 60 percent if from other countries

- In the case of goods included in the list (IV) attached to the Special Consumption Tax Law dated 6/6/2002 and numbered 4760, a single and lump sum tax of 20 percent will be collected in addition to the above rates.

Back

Back