Digital Government and Investment Facilitation

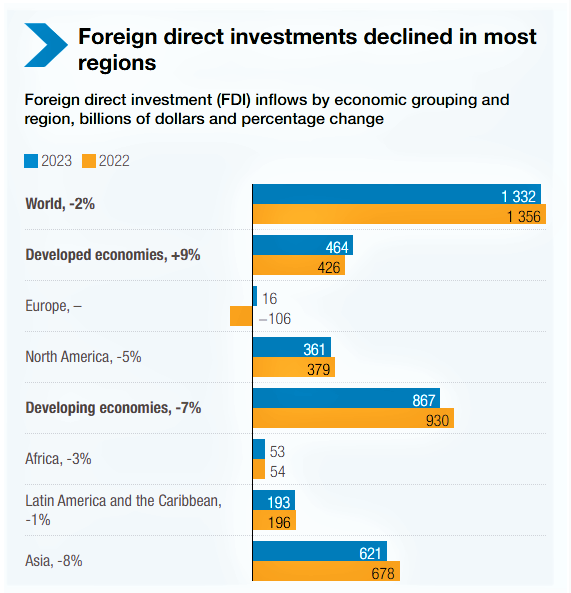

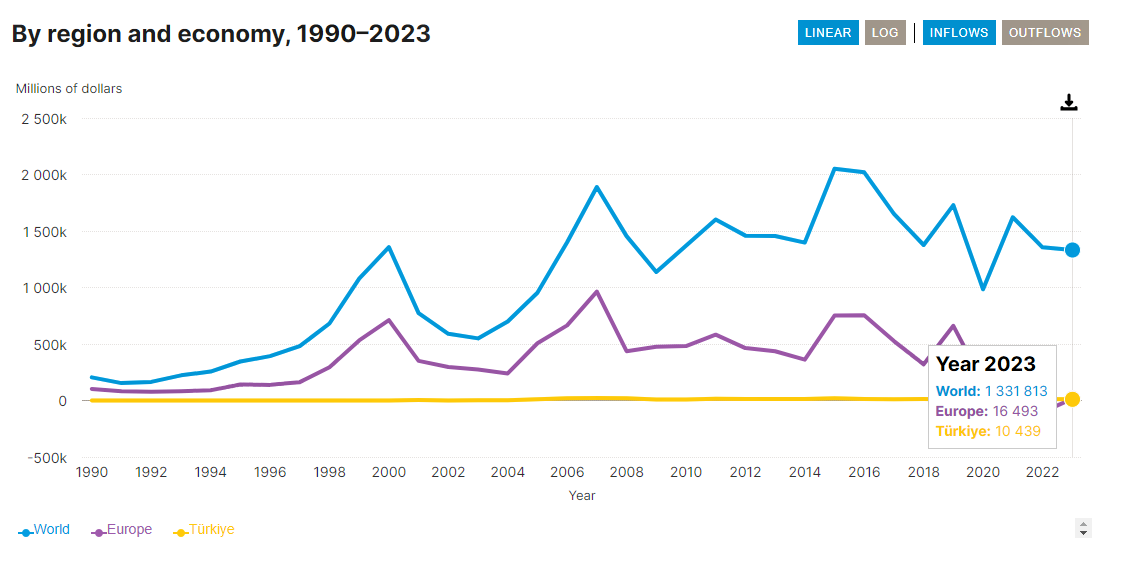

According to the 2024 World Investment Report, global foreign direct investment (FDI) declined by 2 percent to $1.3 trillion in 2023 due to the economic slowdown and rising geopolitical tensions. However, the report underlines that the decline exceeded 10 percent when large fluctuations in investment flows in several European channel economies are excluded.

While the decline in project finance has affected sustainable development, new funding for the Sustainable Development Goals (SDGs) sectors has declined by over 10 percent, particularly in the agri-food and water sectors. This hampers efforts to achieve the ‘2030 Agenda’ and calls for urgent policy action to renew financing for sustainable development.

The report also highlights that business facilitation and digital government solutions can address underinvestment by creating a transparent and facilitated environment. Underlining the significant growth in online services and information portals, the report notes that such tools support broader digital government development and particularly benefit developing countries.

Global foreign direct investment flows fell 2 percent to $1.3 trillion in 2023 as trade and geopolitical tensions weighed on a slowing global economy. Meanwhile, the report notes that the headline figure exceeds 10 percent when excluding a few European channel economies that have recorded large fluctuations in investment flows.

Foreign direct investment flows to developing countries declined by 7 percent to $867 billion.

Tight financing conditions have led to a 26 percent decline in international project finance deals, which are critical for infrastructure investment. International project finance is, therefore, vital for the poorest countries and makes them more vulnerable to the global downturn in such investments.

Crises, protectionist policies, and regional restructuring disrupt the world economy and fragment trade networks, regulatory environments, and global supply chains. This weakens the stability and predictability of international investment flows, creating both barriers and isolated opportunities.

According to the report, the prospects for 2024 may pose challenges, but there is a ray of hope for this year. Modest growth is not only possible, but also likely, thanks to the easing of financial conditions and the concerted investment facilitation efforts in both national policies and international agreements.

Moreover, while investment in global value chain-intensive manufacturing sectors such as automotive and electronics is increasing in regions and countries with easy access to major markets, many developing countries remain marginal, struggling to attract foreign investment and participate in global production networks.

Back

Back