İsmail ÇELİK

Incentive and Guarantee Coordinator

The most important pillar of foreign trade, which has great importance in the development of countries, is export. Increasing exports increases the wealth created in the country and causes production efficiency to increase. Realizing this importance, our country established the first Exporters' Union in 1937 with the signature of Mustafa Kemal ATATÜRK.

Exporters' Associations, whose founding purposes include contributing to the increase of exports, increasing professional solidarity, regulating the professional activities and relations of exporters, finding solutions to their problems and providing guidance, are currently 60 in number, and these Associations operate in 26 export sectors.

In the 21st century, an extremely comprehensive, diverse and complex network of foreign relations has been formed in the world. Today, it is very difficult to think of politics and economic relations independently of each other, and it is accepted that these two elements are in constant interaction. There are many developments that are rapidly increasing in the world that concern more than one country or all the countries of the world, and as a result, efforts to find regional and multilateral solutions to such regional and global issues are increasing. Turkey, located in one of the most strategic regions of the world, is increasingly taking its place in this process.

It is vital to determine the sectors and regions to be encouraged to ensure development and growth. Our state has dozens of institutions that provide grants and incentives. Nearly 60 institutions and organizations provide government grants and supports.

Country economies face recessions or crises from time to time. In such periods, production and consumption in the country decrease, employment and investments decrease, and investments in R&D and innovation decrease to zero level. Governments try to reduce the impact of recession or crisis on the market by intervening in these situations in the economy with various methods. State supports are one of them. State supports are not only implemented in times of crisis or recession. Countries also provide support to strengthen and grow their economies. Support is also provided to increase existing production, consumption, investment and employment.

State Supports can be direct to companies or indirectly by regulating the market conditions of companies. Example of Direct State Support; These can be listed as employment supports to increase employment, marketing supports to increase sales, support of export activities to increase exports, and entrepreneurial supports to encourage entrepreneurs.

Establishment of an organized industrial zone, tax exemptions, construction of transportation roads, and the state's postponement of receivables from companies can be given as examples of Indirect State Supports.

We can list the incentives and grants subject to State Aid as follows:

1- Possible State Supports and Calculation Example

2- Grant Support

3- Credit Supports

4- Easy Support (Ministry of Commerce)

5- Export Supports (Ministry of Commerce)

6- Service Sector Supports (Ministry of Commerce)

7- Technical Customers Abroad Service (Ministry of Commerce)

8- Inward Processing Regime (Ministry of Trade)

9- Investment Incentive (Ministry of Industry and Technology)

10- Outward Processing Regime (Ministry of Trade)

11- Eximbank Export Credits (Affiliated to the Ministry of Commerce)

Many people who want to benefit from government support are confused about where to start. In fact, this is understandable because there are many options for receiving support from the state. For new and determined entrepreneurs, starting a business can be a bit intimidating. For this reason, before starting business, it would be a better approach to research government supports, learn about the grants and incentives given, and start a business accordingly. Contrary to popular belief, support is given under different names to businesses, tradesmen, SMEs, farmers, entrepreneurs and housewives in our country.

It would be appropriate to mention these supports one by one.

- Market Entry Support

- Grant Support

I- R&D Supports

- KOSGEB Support

- Support from the Ministry of Industry and Technology

- Support from the Ministry of Food, Agriculture and Livestock

II- EU Programs

III- Ministry of Commerce

- For Export Supports

- Investment Incentive System Support (Ministry of Industry and Technology)

- Service Sector Supports

3-Credit Supports

Domestic Credit Support

- Türkiye Development Bank Loans

- Eximbank Loans

International Credit Support

- World Bank Sourced Geothermal Energy Development Loan

- Islamic Development Bank Loans

- SME and Large Business Loans Sourced from the European Investment Bank

- German Development Bank Loans

- Environment and Energy Loans Sourced from the European Investment Bank

- European Investment Bank Hotel Renovation Loans

4-Easy Support (Ministry of Commerce)

Easy Support is a site that aims to present 14 different supports provided by the Ministry of Commerce in an easier and more understandable way. Numerous supports are available here, from finding customers when exporting to advertising abroad, from participating in fairs to finding suitable loans for customers.

5-Export Supports (Ministry of Commerce)

State aid for exports, carried out by the Ministry of Commerce, is carried out with a holistic perspective aiming to provide support to companies in the process of expanding abroad. There are three maturity levels in support: export preparation, marketing and branding.

6-Service Sector Supports (Ministry of Commerce)

It is a support for supporting the trade and branding of service sectors such as technical consultancy, health tourism, film, education, informatics and management consultancy.

7-Supports Provided to Technical Consultancy Services Abroad (Ministry of Commerce)

It is carried out within the scope of a comprehensive State Aid program for technical consultancy services of the Ministry of Commerce. With this program, technical consultancy companies' offices abroad, advertising, promotion and marketing activities, participation in foreign fairs, seminars and conferences, market research travels, professional liability insurance and software expenses, participation in overseas technical training programs and international professional competitions, at least 4 participating companies. The overseas delegations they organize with and the technical consultancy works they receive as a result of the tenders they enter abroad are supported with the resources provided by the Price Stabilization and Support Fund.

INVESTMENT INCENTIVE SYSTEM

Investment Incentive Certificate is a document issued to support investments by the state in order to eliminate inter-regional imbalances, create employment and ensure international competitiveness by directing savings to investment, using high value-added, advanced and appropriate technologies.

Applications regarding the lists of imported machinery and equipment annexed to the "Investment Incentive Certificate" issued by the Ministry of Industry and Technology, transactions regarding the issuance and use of the permit, in accordance with the circular numbered 2016/34, with the Communiqué numbered 2018/2, all transactions are carried out through the Electronic Incentive Application and Foreign Capital Information System ( It allows this to be done via E-TUYS).

Investments are supported within the framework of the Presidential Decree (former Council of Ministers Decision) and the provisions of the notification regarding the implementation of this Decision. The "Decision on State Aids in Investments" numbered 2012/3305 entered into force by being published in the Official Gazette dated 19.06.2012, and the Implementation Communiqué numbered 2012/1 was published in the Official Gazette dated 20.06.2012.

The Purpose of the Investment Incentive System is to increase the production of intermediate goods and products with high import dependency in order to reduce the current account deficit, to support high and medium-high technology investments that will ensure technological transformation, to increase investment supports provided to the least developed regions, to reduce regional development differences, to increase the effectiveness of support elements. It is defined as increasing and supporting clustering activities.

Investment Incentive System includes "Regional Incentives" that aim to reduce the development gap between provinces and increase the production and export potential of provinces, "Priority Investment Issues" that aim to support certain investment issues with 5th region supports, "Strategic Investments" with high added value that will contribute to reducing the current account deficit. prioritizes "Large Scale Investments" that will increase technology and R&D capacity and provide competitive advantage. Other incentives other than these are called "General Incentives". The support elements included in the Investment Incentive System are listed in the table below:

In addition, conferences and seminars, advertising, promotion and marketing activities to be organized by technical consultancy, contracting and construction material sector organizations both at home and abroad, fair organizations and delegations to be organized abroad are supported by the Price Stabilization and Support Fund.

Minimum investment amounts to be encouraged within the scope of the Investment Incentive System have been determined.

Accordingly, the minimum fixed investment amount to be made within the scope of the incentive system is I. and II. 1 million TL in Regions III, IV, V and VI. It should be 500 thousand TL in the regions. Although the minimum fixed investment amount for Large-Scale Investments varies depending on the investment subject, it is determined as minimum 50 million TL. The minimum fixed investment amount determined for Strategic Investments is 50 million TL. For Regional Incentive Applications, it is determined separately for each supported sector and each province, starting from a minimum of 500,000 TL. It aims to reduce the development gap between provinces and increase the production and export potential of the provinces. Aid intensities are differentiated according to the development levels of the provinces. The sectors to be supported were determined by taking into account the potential and economic scale of the provinces. The provinces are divided into 6 regions based on the SEGE 2011 study. These regions and the provinces included in the regions are shown in the table below:

The support elements provided in regional incentive practices are listed in the table below:

In Regional Incentive Applications, VAT Exemption, Customs Duty Exemption, Tax Deduction, Insurance Premium Employer Share Support, Interest Support (in the 3rd, 4th, 5th and 6th Regions), if they provide the minimum capacity or amounts to the sectors determined by province in the annex of the Decision. Investment Site Allocation, Insurance Premium Support (in the 6th Region) and Income Tax Withholding Support (in the 6th Region) are provided.

PRIORITY INVESTMENTS

Investment topics benefiting from regional supports

"Manufacture of pharmaceutical, office, accounting and data processing machines", "manufacture of radio, television, communication equipment and devices", "manufacture of medical instruments, precision and optical instruments and watches" and "manufacture of air and space vehicles" are the priority sectors that benefit from regional supports. is included in the investments.

These "priority investments" are provided with VAT exemption, customs duty exemption and investment location support. In addition, 40% investment contribution rate, 80% tax deduction, 7-year employer share support for insurance premiums, 5 points interest support for domestic loans, and 2 points interest support for foreign currency/foreign exchange indexed loans are provided for the mentioned investments.

STRATEGIC INVESTMENTS

In order to benefit from Strategic Investment supports, the minimum fixed investment amount must be over 50 million Turkish Liras, the total domestic production capacity must be less than imports, the added value must be at least 40%, and the total import amount in the last year must be over 50 million USD. Priority investments with a minimum fixed investment amount of over 3 billion Turkish Liras are also considered "strategic investments".

VAT Exemption, Customs Duty Exemption, Tax Deduction, Insurance Premium Employer Share Support, Investment Location Allocation, Interest Support, VAT Refund, Insurance Premium (Worker Share) Support (in the 6th Region), Income Tax Withholding Support (in the 6th Region) for strategic investments.) support is provided.

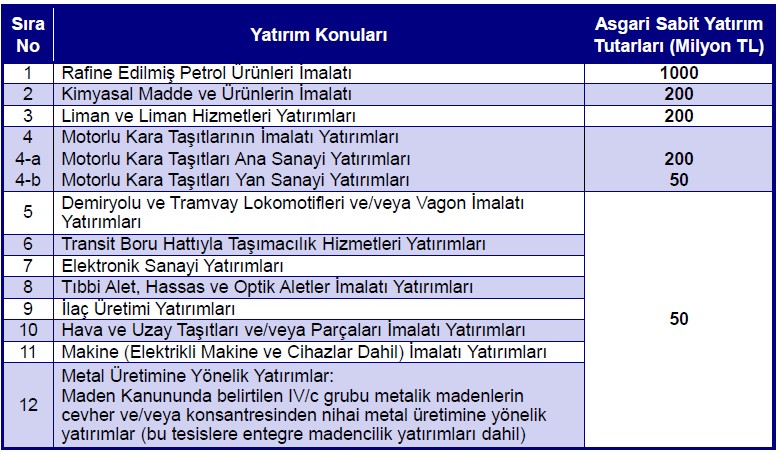

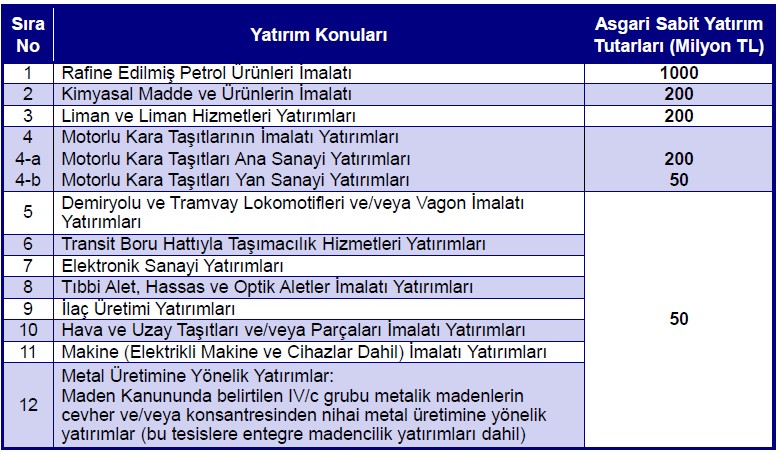

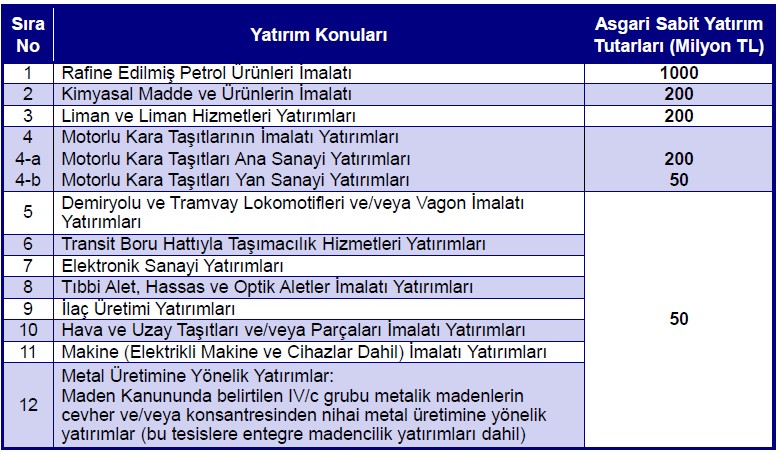

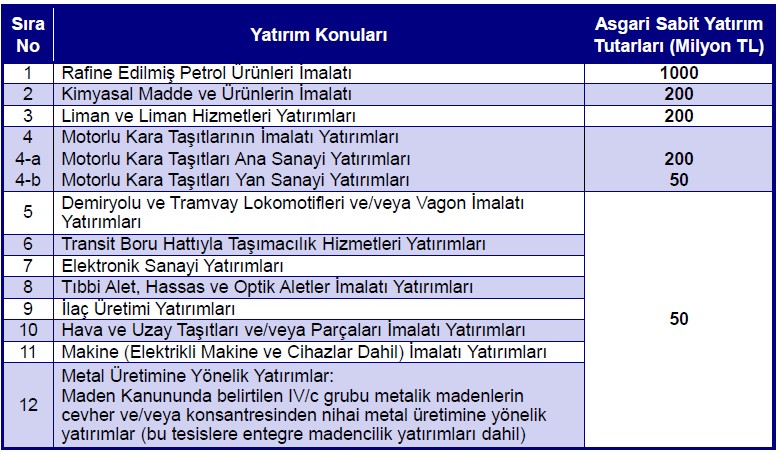

LARGE SCALE INVESTMENTS

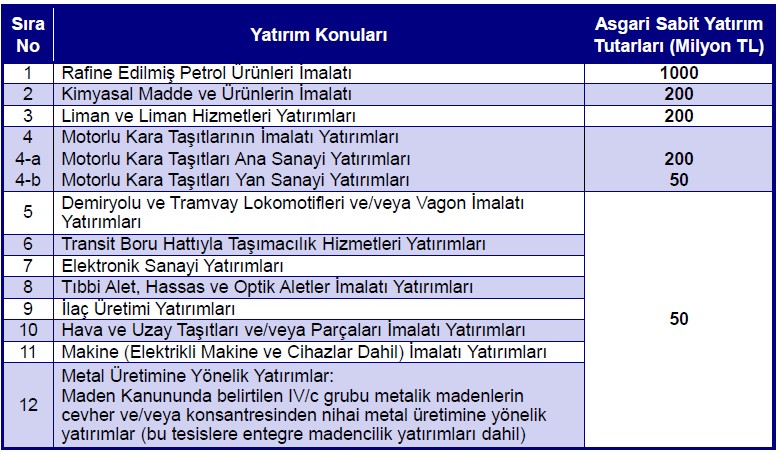

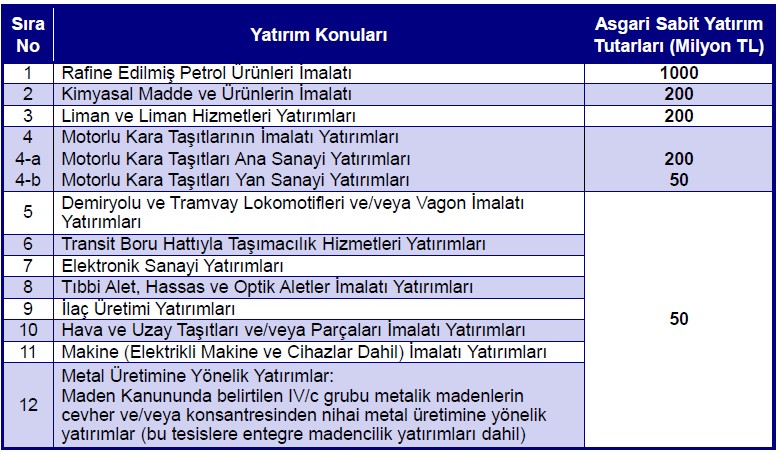

It aims to support investments that will increase technology and R&D capacity and provide competitive advantage in the international arena. The investment subjects and minimum fixed investment amounts to benefit from the support are listed in the table below:

VAT Exemption, Customs Duty Exemption, Tax Deduction, Insurance Premium Employer Share Support, Investment Location Allocation, Insurance Premium (Worker Share) Support (in the 6th Region), Income Tax Withholding Support (in the 6th Region) support is provided for large-scale investments. The mentioned support elements are provided as stated in the table below:

GENERAL INCENTIVE PRACTICES

These are investments that are not included in the scope of investment subjects to be encouraged and other incentive practices, regardless of region, and that meet the specified minimum fixed investment amount requirement. VAT Exemption, Customs Duty Exemption and Income Tax Withholding Support (6th Region) are provided for such investments.

Source:

Ministry of Industry and Technology Web Portal

OAIB Web Portal

KOSGEB Web Portal

QUESTIONS AND ANSWERS

Question 1. What is State Aid in Investments?

Answer: These are supports provided by the state in order to reduce development differences between regions, increase investment and encourage employment in underdeveloped and developing regions. Accordingly, Turkey is divided into regions in terms of development ranking, and the sectors and investments to be encouraged and incentive tools are determined for the investments to be made in each region.

Question 2. How can one benefit from State Aid in investments?

Answer: In order to benefit from State Aid for investments, it is necessary to obtain an "Investment Incentive Certificate".

Question 3. What is an Investment Incentive Certificate?

Answer: Investment Incentive Certificate is a document issued for investments to be carried out in line with the purposes of the decision regarding the incentive system, which contains the characteristic values of the investment, provides the opportunity to benefit from the support elements registered on it if the investment is carried out in accordance with the specified minimum conditions.

Question 4. Who can apply to receive an Investment Incentive Certificate?

Answer: Real persons, ordinary partnerships, capital companies, cooperatives, business partnerships, public institutions and organizations (general and special budget institutions and organizations, special provincial administrations, municipalities and public economic enterprises, and institutions whose share ratio in the capital composition exceeds 50%) and organizations), professional organizations, associations and foundations that are public institutions, branches of foreign companies abroad in Turkey and companies with foreign capital established in accordance with the Turkish Commercial Code can apply to receive an Investment Incentive Certificate.

Question 5. To whom cannot the Investment Incentive Certificate be given?

Answer: Those who have SSI debts and have not restructured their debts, whose total debts of overdue insurance premiums, unemployment insurance premiums, administrative fines and related delay penalties and late payment interest are more than the monthly gross minimum wage, and who wish to postpone and install the said debts or various Investment Incentive Certificates are not given to businesses that do not restructure these debts.

Back

Back