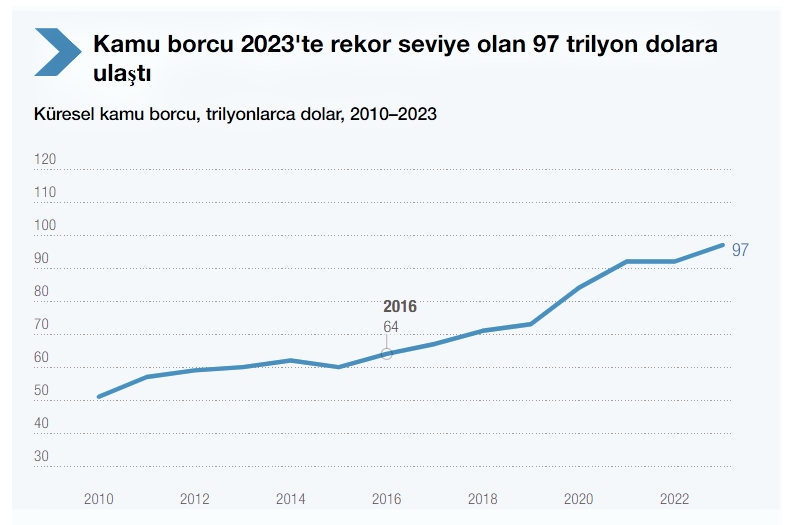

Global public debt has doubled since 2010, reaching 97 trillion dollars in 2023. More than 40 percent of the world's population lives in countries that spend more on debt interest payments than education and health.

As the UN Organization for Trade and Development (UNCTAD) celebrates its 60th anniversary, it is committed to examining the issues that will shape the future of trade and development. The “Moving Forward Together” series explores important topics such as public debt, which holds great promise and challenges for developing countries.

The aim of the Forward Together series;

- Tackle the growing challenges of public and external debt,

- Making e-commerce and the digital economy work for everyone,

- Building more diverse and resilient economies,

- Making trade work better for the planet.

Rising public debt greatly constrains economic growth and limits investment in development-critical sectors such as infrastructure, health, and education. It also leads to a vicious cycle of borrowing and repayment, risking default and economic crisis, as seen in the Latin American debt crisis of the 1980s (often referred to as the “lost decade”).

Moreover, global public debt has doubled since 2010, reaching an all-time high of $97 trillion in 2023. Some 3.3 billion people (more than 40 percent of the world's population) now live in countries that spend more on debt interest payments than education or health.

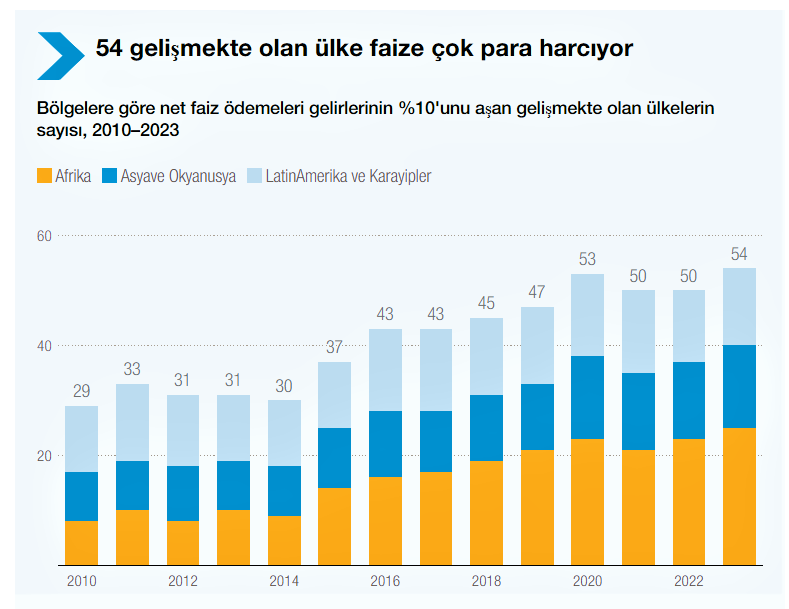

Moreover, in 2023, 54 developing countries, almost half of them in Africa, allocated at least 10 percent of their government funds to debt interest payments.

“There is a worrying tendency in the international community to view debt in developing countries as sustainable because it can be repaid after some sacrifice,” said Rebeca Grynspan, UN Secretary-General for Trade and Development. ”This view ignores the skipped meals, foregone investment in education and lack of health spending, and reduced investment in infrastructure to make room for interest payments.”

A Coming Widespread Debt Crisis

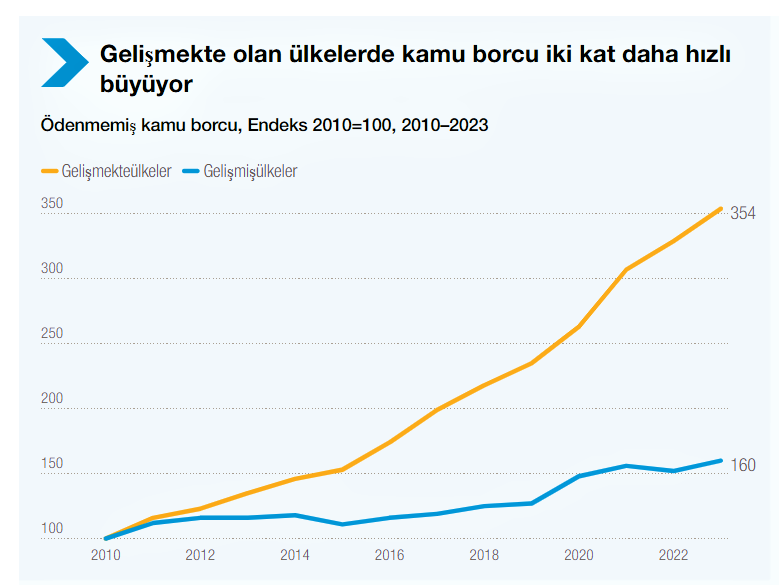

Over the past decades, developing countries have seen a significant increase in external public debt, driven by a combination of factors including borrowing for development projects, fluctuating commodity prices, and the need to finance deficits.

By the end of 2022, the external debt (funds borrowed in foreign currency) of emerging market economies increased by 15.7 percent to USD 11.4 trillion. With half of low-income countries and about a quarter of emerging market economies in or close to debt distress, the likelihood of a global debt crisis is high. Equally worrying is the rising cost of servicing public debt, which is constraining developing countries' budgets.

In 2023, developing countries paid $847 billion in net interest, up 26 percent from 2021. They borrowed internationally at rates two to four times higher than the United States and 6 to 12 times higher than Germany. Moreover, in 2023, 54 developing countries, almost half of them in Africa, devoted at least 10 percent of their government funds to debt interest payments. However, the COVID-19 pandemic has exacerbated the situation, with countries borrowing heavily to mitigate its economic impact and support public health measures.

The role of UN Trade and Development in supporting developing countries efforts to manage public debt

Through research, technical cooperation, and consensus building, UN Trade and Development help developing countries manage their public debt more effectively and advocates for a realignment of the international debt architecture to meet their needs.

Research and Analysis

By conducting rigorous research and policy analysis to inform global and national debt management strategies, UNCTAD ensures timely analysis of the most important developments and emerging issues in the field of international debt.

Key publications include the annual Trade and Development Report and the United Nations Secretary-General's external debt report to the General Assembly, which analyzes key issues related to external debt in developing countries and facilitates deliberations on debt resolution in the General Assembly.

Technical Cooperation

UNCTAD tailors its technical assistance to meet the changing debt needs of developing countries. For example, since 1981, the Debt Management and Financial Analysis System (DMFAS) program has helped more than 115 institutions in 75 countries, including least-developed countries such as Mauritania and Chad, strengthen their capacity to effectively manage public debt.

By providing debt management tools and training, the program enables countries to better record, monitor, analyze, and report on their public finances and debt portfolios.

The Sustainable Development Finance Assessment analyzes the impact of the COVID-19 crisis on external fiscal and public debt sustainability in selected developing countries. It also identifies the financing needs of these countries to achieve key SDGs while ensuring compliance with financial and debt sustainability.

Building Consensus

UN Trade and Development organizes the biennial International Debt Management Conference. The conference brings together senior national and international debt managers and experts from around the world to discuss the most important issues in the areas of external and domestic debt, debt management, and public finance.

Similarly, it organizes an annual intergovernmental expert group meeting on financing for development, providing a forum to discuss issues and challenges in implementing the Addis Ababa Action Agenda for financing sustainable development and the 2030 Agenda for Sustainable Development. It also contributes to the G20 Working Group on International Financial Architecture.

Debt sustainability frameworks are at the heart of the Organization's consensus-building efforts. In collaboration with international organizations, it promotes these frameworks to guide responsible borrowing and maintain manageable debt levels. In addition, UN Trade and Development advocates for fair and transparent debt restructuring processes and supports international discussions and negotiations to ensure inclusive and equitable debt relief measures.

Let's move together towards sustainable and inclusive debt solutions.

UN Trade and Development calls for a comprehensive reform of the global financial architecture to prevent a widespread debt crisis and create a more sustainable, inclusive system.

Its key recommendations include the following:

- Increase concessional loans and grants. Increase the core capital of multilateral and regional banks to enhance their lending capacity. Issue special drawing rights (SDRs), a form of international currency created by the IMF for member countries to increase their monetary reserves.

- Increased transparency in financing terms and conditions. Take legal measures to reduce resource and information asymmetries between borrowers and lenders and to discourage predatory lending practices.

- Expand developing countries' access to foreign currencies through central bank swaps.

- Enhancing their resilience during external crises. Implement standstill rules on borrowers' obligations, such as climate-resilient debt clauses, to allow debt repayments to be halted and provide breathing space for crisis management.

- Develop rules for automatic restructurings and a better global financial safety net within the global debt architecture.

- Establish a global debt authority to coordinate and guide sovereign debt restructuring.

Looking to the future, UN Trade and Development remains committed to supporting developing countries in addressing the complexity of external public debt. It is confident that through rigorous analysis, cooperation, and forward-looking advice, it can realign the global debt architecture to the needs of developing countries.

Back

Back