Europe needs to better support venture capital to boost growth and productivity. Reforms in this context could increase investment in high-tech ventures that support innovation.

One reason for the bloc's low productivity growth is the failure of innovative startups to transform sufficiently into “superstar” firms. Europe's fragmented economy and financial system are partly at the root of this problem. Without a more frictionless single market for goods, services, labor, and capital, it is more expensive and difficult for successful enterprises to scale up.

On top of that, Europe's bank-based financial system is not well suited to finance risky ventures. High-tech startups develop new technologies and business models that are often risky and difficult for banks to assess. And the value of startups usually lies in their people, ideas, and other intangible capital. This is very difficult to pledge as collateral for a bank loan. Banks are also (rightly) constrained by rules that limit unsecured lending to risky firms (even fast-growing firms that are likely to make big profits later on).

Private capital pools in Europe are also smaller and more fragmented than in the US. Europeans invest a larger share of their savings in bank accounts rather than in capital markets. In 2022, Americans invested $4.60 in equities, mutual funds, and pension or insurance funds for every dollar Europeans invested in such assets. This is partly because Europeans rely more on pay-as-you-go pensions than Americans. But whatever the reason, the bottom line is that equity financing is becoming less available to companies.

Market fragmentation is partly due to national laws, regulations, and taxes that prevent cross-border consolidation, capital raising, and risk sharing. Many institutional investors prefer to allocate their capital to companies in their home country. This is also the case for venture capital investments, especially small funds. In this case, more venture capital could stimulate investment productivity and strengthen the EU's innovation ecosystem. But Europe's shallow venture capital pools are starving innovative startups of investment and making it harder to drive economic growth and raise living standards.

Recent studies show that measures to strengthen the EU's venture capital markets and remove cross-border financial barriers for pension funds and insurers to invest in venture capital could increase the flow of funds to promising startups and accelerate productivity gains.

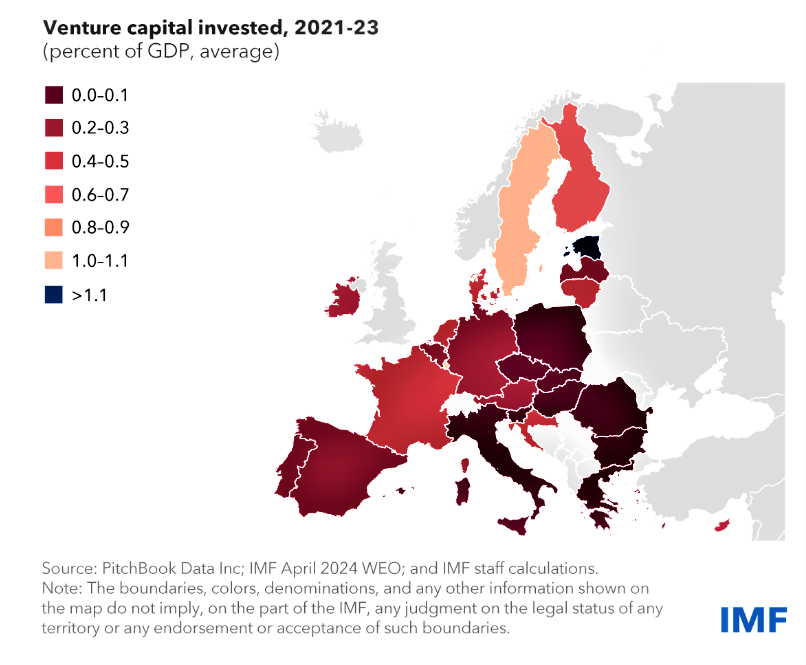

In the EU, the UK lost its largest venture capital hub in London after voting to leave the Union in 2016, and the remaining hubs lack the scale of those in the US. Over the past decade, EU venture capital investment has averaged just 0.3 percent of GDP, less than a third of the US average. During this period, American venture capital funds raised $800 billion more than their European counterparts.

Compared to their transatlantic competitors, Europe's more established startups have less attractive options to grow through initial public offerings in the EU. This significantly reduces the incentives to invest in them in the first place. Moreover, when fast-growing startups start scaling up quickly, they often have to seek financing abroad, as financing opportunities in Europe are limited. Many startups move their operations abroad after securing scale-up financing from abroad. Europe then loses many of the benefits of startups succeeding in their home country, both direct growth effects and positive spillovers such as technology diffusion.

While government interventions are often not a perfect solution, they may be needed in the near term to accelerate the development of the venture capital sector and the financing of innovative startups. This will not only stimulate the productivity of the European Union but also increase its competitiveness. Moreover, more venture capital financing for “Clean Tech” sectors would also support the EU's green ambitions and reduce the need for costly subsidies that can distort the single market.

Back

Back