Diversified Trade Can Make the Middle East and Central Asia More Resilient.

Reducing trade barriers, easing regulatory restrictions, and improving infrastructure can ease challenges and help countries capitalize on new opportunities.

The pandemic, geoeconomic fragmentation, and displacements resulting from the Russia-Ukraine war have dramatically changed the dynamics of world trade. While this has created challenges, it has also created new opportunities for trade reorientation, especially for the Caucasus and Central Asia.

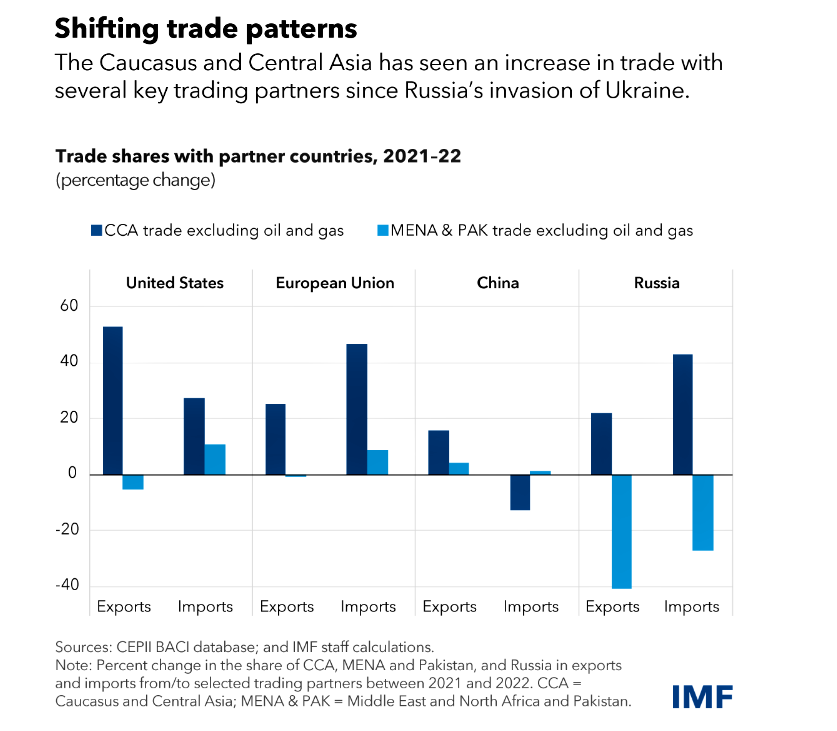

Since the start of the war, the region's economies have continued to show resilience, and trade has increased in many countries, partly due to alternative trade routes. Armenia, Georgia, and the Kyrgyz Republic have seen their share of non-oil and gas trade with significant partners such as China, the European Union, Russia, and the United States rise to as high as 60 percent in 2022. GDP growth in the Caucasus and Central Asia is projected to remain strong at 3.9 percent in 2024 and rise to 4.8 percent in 2025, albeit at a slightly slower pace.

Of course, changing trade patterns have created opportunities elsewhere. For example, Middle Eastern and North African countries such as Algeria, Kuwait, Oman, and Qatar have nearly doubled their energy exports to the European Union in 2022-23 to meet growing demand for non-Russian oil and gas.

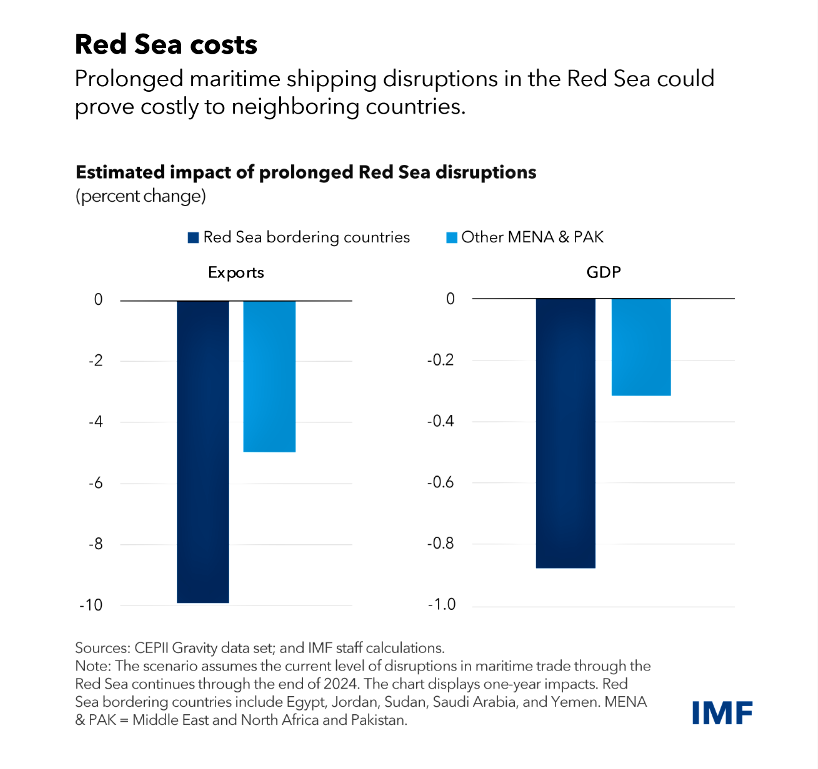

Recently, however, the Red Sea shipping incursions resulting from the conflicts in Gaza and Israel have not only disrupted maritime trade and affected neighboring economies but have also increased the level of uncertainty. Since the start of the conflicts in Gaza and Israel, transit through the Suez Canal has decreased by more than 60 percent as ships have been diverted to the Cape of Good Hope. Cargo volumes have shrunk sharply at Red Sea ports such as Al Aqaba in Jordan and Jeddah in Saudi Arabia. Some trade has also been rerouted within the region, including to Dammam, Saudi Arabia, and the Persian Gulf.

The potential for continued disruptions in the Red Sea is a cause for serious concern, as it could lead to major economic consequences for the most affected economies. According to a scenario in the latest Regional Economic Outlook, the Red Sea countries (Egypt, Jordan, Saudi Arabia, Sudan, and Yemen) could face a staggering loss of around 10 percent of their exports and an average of 1 percent of their GDP if the disruptions persist until the end of this year.

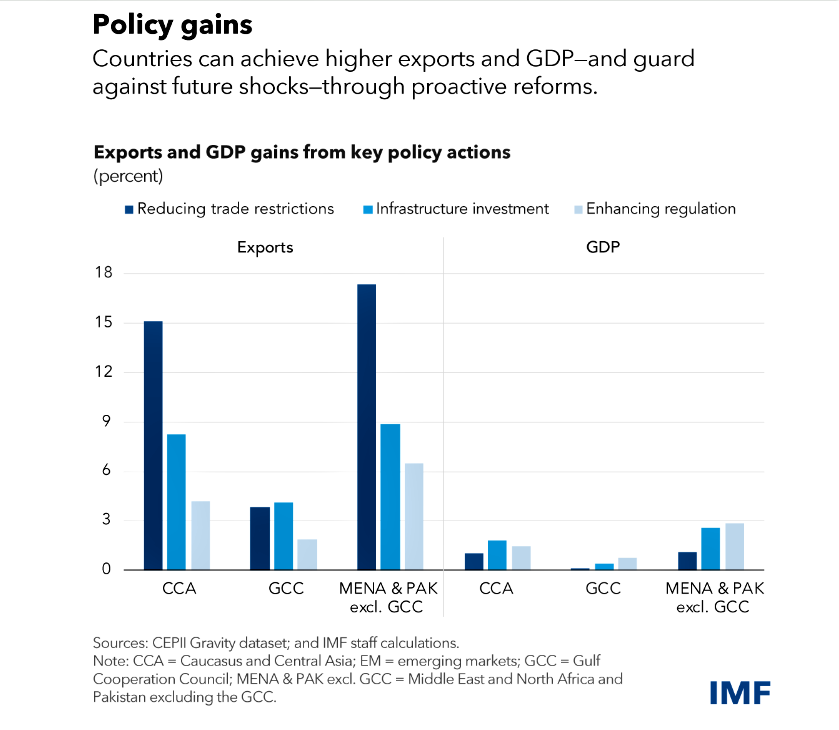

In the current uncertain international trade environment, strategic foresight and proactive policy reforms will enable countries to realize trade and revenue gains. Meeting the challenges posed by these shocks and seizing the opportunities ahead will require countries to address trade barriers from high non-tariff restrictions, infrastructure deficiencies, and regulatory inefficiencies.

Targeted policy reforms can help, but preparation is crucial. Research shows that reducing non-tariff trade barriers, increasing infrastructure investment, and improving regulatory quality could boost trade by up to 17 percent over the medium term. In comparison, economic output could be 3 percent higher. This would also increase resilience to future trade shocks.

A look at past reforms shows that effective action is possible. In this context, Uzbekistan has increased its attractiveness to foreign investors and deepened its integration into the global economy by eliminating exchange controls and improving the business environment. Saudi Arabia has also attracted international businesses while growing its non-oil economy through its Vision 2030 reform plan, which includes easing regulatory restrictions on trade and investment. Similarly, Azerbaijan's investment in the Baku-Tbilisi-Kars railway, an essential part of the Middle Corridor, has increased cargo capacity between Asia and Europe, highlighting the potential for infrastructure investments. Such initiatives underscore the transformative power of targeted policy reforms to adapt to and thrive in the global trade environment.

In this context, countries in the MENA region can mitigate ongoing transport disruptions by improving supply chain management, finding new suppliers in the most affected sectors, seeking alternative transport routes, and assessing air transport capacity needs. In the medium term, countries can increase their resilience to trade disruptions by strengthening and expanding regional connectivity. Of course, in response, it will be essential to invest in transport infrastructure, including developing innovative sea-land routes.

Stakeholders must recognize the urgency and necessity of building a more diversified trade profile, covering products and routes. This strategic move will not only significantly bolster the region's ability to withstand disruptions but also open up new avenues for growth and prosperity. Moreover, the changing trade patterns provide a unique opportunity for countries to redefine their place in the global economic framework. The time for action is now.

Back

Back