Potential home buyers face high prices and high borrowing costs, while homeowners must sell their properties more.

As global central banks raise interest rates to contain inflation, house prices also retreat relative to the start of the upcycle. However, despite the housing market's sensitivity to higher policy rates, prices are still above historical averages. House prices in advanced economies, including most European Union countries, as well as in Africa and the Middle East, are 10 percent to 25 percent higher than pre-pandemic levels.

Rising interest rates have been quickly reflected in mortgage markets, hampering affordability for existing and potential home buyers, while a lack of housing supply has limited purchases in some regions. Therefore, housing affordability has become even more complicated, with high house prices and interest rates rising.

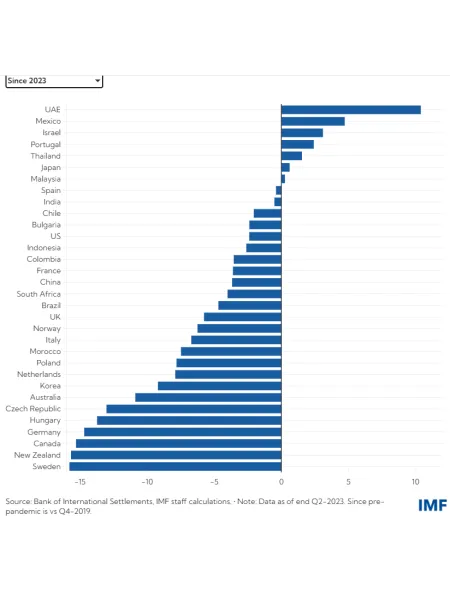

In the first half of 2023, mortgage rates in advanced economies rose by more than two percentage points year-on-year. Therefore, countries such as Australia, Canada, and New Zealand witnessed significant natural house price declines during this period, likely due to the high share of adjustable-rate mortgages and the decline in house prices since before the pandemic. Comparatively, house prices fell by more than 15 percent in some advanced economies, while the decline in emerging economies was less pronounced. On a net basis, however, accurate house prices must decline from the highs of 2021 and 2022 to reach pre-pandemic levels.

According to the latest Global Financial Stability Report, higher borrowing costs are likely to impact household debt service ratios - a measure of borrowers' ability to repay loans - in countries where housing markets remain overvalued, and mortgage loans have shorter average lives.

Approval and Repayment

For example, in some advanced economies with previously double-digit household debt service ratios, such as Norway, Sweden, Denmark, and the Netherlands, borrowers' debt service costs could increase by up to 1.8 percentage points, given the increase in interest rates. Of course, this would have consequences for loan approvals and borrowers' ability to repay. But following the logic that borrowers are also less indebted, the risk of rising loan defaults has been reduced as credit standards have been strengthened since the global financial crisis. This should support house prices by limiting forced sales or foreclosures.

In the United States, the Federal Reserve's interest rate hike has led to significant changes in the mortgage market, with the average rate on a 30-year fixed mortgage recently hitting a twenty-year high of 7.8 percent. For potential buyers, entry costs make homeownership even more out of reach, as the required down payments have also become a prohibitive factor due to the reduction in savings since the pandemic.

Existing homeowners, who are therefore deterred from buying new properties due to higher monthly mortgage payments, stay put, resulting in a reduced supply of available homes. This phenomenon, known as the "lock-in" effect, is particularly pronounced in the United States, where long-term fixed-rate mortgages are most popular. Average 30-year mortgage rates currently stand at 6.6 percent, nearly three percentage points above the pandemic low, while mortgage starts are 18 percent below last year's. As mortgage rates continued to ease, refinancing applications rose 8.5 percent over the year.

Rates and Refinancing

According to ICE Mortgage Technology, 30-year fixed-rate mortgages accounted for 90 percent of new home loans in the US at the end of last year. According to the same data, almost two-fifths of all US mortgages were reissued in 2020 or 2021. Low-interest rates during the pandemic allowed many Americans to refinance their home loans.

But high-interest rates are also driving up rental costs. This is why many people choose to rent rather than buy, as home prices are slow to adjust. In this context, the combination of high-interest rates and still scarce housing supply creates a vicious circle that makes it harder for central banks to fight inflation. Monthly house prices in the US continued to rise in October compared to a year ago, and housing prices accounted for a third of the change in consumer prices in November.

If the Fed starts cutting rates this year, as policymakers and market participants anticipate, mortgage rates will continue to adjust, and pent-up housing demand will be released. Of course, a sudden increase due to rapid rate cuts could offset improvements in housing supply, causing prices to rise again.

Geri

Geri